Bold statement of the day: Instagram is the single most important “thing” in sneakers.

Instagram’s impact on every aspect of the sneakerhead world cannot be overstated and, yet, is nearly impossible to quantify. Influence, inspiration, information, marketing, social relevance, friendships and credibility are just some of a long list of ways Instagram impacts our community. Perhaps at the top of that list: Instagram has transformed the resell game. So it should come as no surprise that we’ve been banging our heads against a wall for over three years trying to measure IG sneaker sales. About six months ago we finally got serious. What follows is our best attempt at a very hard analysis.

BACKGROUND

The exponential growth of the sneakerhead community over the past five years is, to most of us, old news by now. Campless was born out of a desire to quantify that growth and use the insights derived from that analysis to better understand the sneakerhead world around us. One of those foundational insights is that we can pinpoint the exact moment the sneakerhead world went from underground sub-culture to mainstream fodder: NBA All Star Weekend, February 2012.

No one alive at the time (yes, I’m calling out 2-year-old hypebeasts – you know who you are!) has forgotten about the Galaxy Foam release. Was this the first time sneaker camp-outs turned ugly? Definitely not. Was this the first time someone offered to trade their car for a pair of kicks? Maybe not. But this was the first time the mainstream media covered the hysteria with such intensity and fervor since the 1991 “Your sneakers or your life” Sports Illustrated cover.

There were many reasons this happened, but three stand out:

- The convergence of the sneaker world’s biggest event; with

- Nike reaching the pinnacle of using limited release shoes to drive hype; and

- Instagram hitting its own hockey-stick growth (see growth chart here)

As millions of people, and tens of thousands of sneakerheads, rushed to figure out what a “filter” was, somewhere along the way there was a mass light-bulb-over-the-head-going-off moment. We now had the most fundamental tool of all, a dead-simple way to do the one thing every sneakerhead has ever wanted: flex. For years the quintessential sneakerhead question was “Where’d you get those?” (shout out Bobbito). Now we could play that game globally, from our phone. Fuck yeah.

If there is one fundamental truth about the larger sneakerhead market, it’s this: Anywhere sneakerheads come into contact with other sneakerheads, reselling will occur. Instagram is no different. It’s just a lot less structured than other channels, so it took longer to flourish and is exponentially harder to quantify.

METHODOLOGY

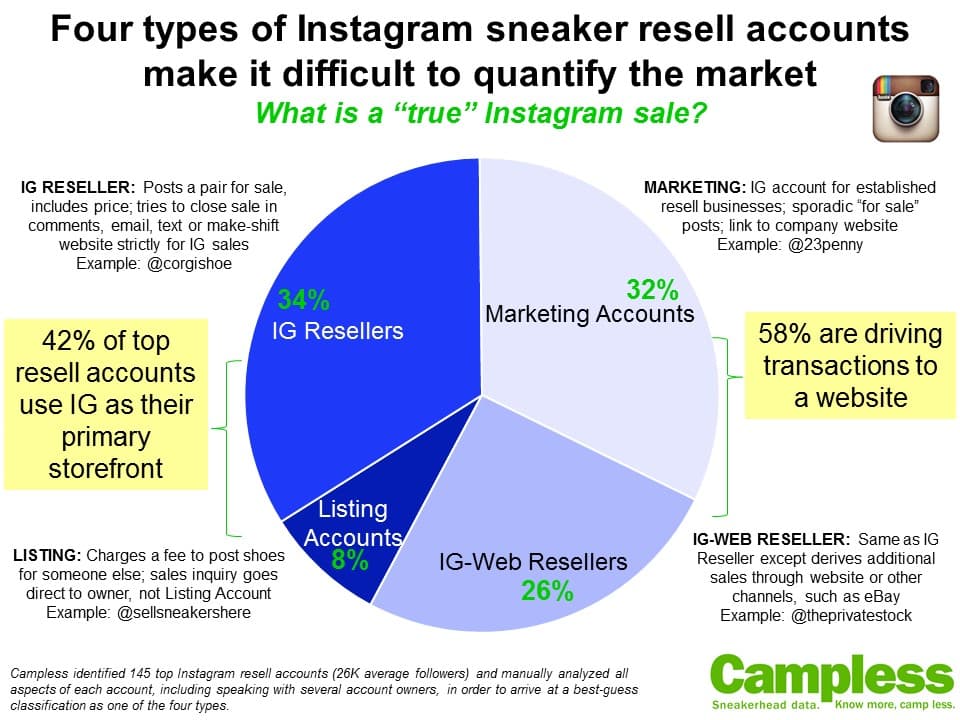

There are essentially four types of resell accounts on Instagram:

There’s actually a fifth type of resell account: Content Accounts. This is what Instragram was built for; someone posts a picture and others look at it. Although the account owner is not posting kicks for sale, reselling often takes place in the comments. Someone posts a picture of sneaker X. Someone else comments: “I got a size 10 for sale.” Someone else posts: “I’ll take the 10.”. “Text me.” “OK”. And that, folks, is commerce. That is also about the single most unstructured, most difficult-to-track sneaker sale in the entire world. So we don’t even try.

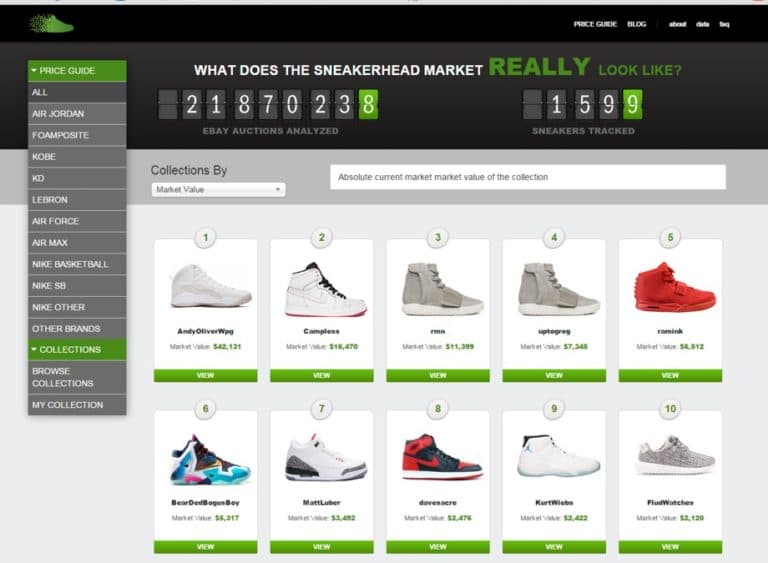

Sneaker sales from the four resell accounts listed above are also very difficult to track. In fact, we had to ask ourselves what an Instagram sale even is. We identified 145 top IG accounts in the resell game, but more than half of them (58%) are driving their followers to a website or brick & mortar store. Only 42% are even using Instagram as their primary resell vehicle. This is one of many issues we would have to face…

Over the past six months we’ve built a methodology which takes into consideration all of the data we can collect, considers the fundamental differences between the four accounts, and uses sampling, estimation and assumptions. Wherever possible, all assumptions are based on learnings from other sneakerheadata work (for example, our many eBay analyses) or have been validated by direct interviews with account owners.

The first step in understanding the methodology is to go deeper on the four accounts. We need to understand the differences between each account and what data can be collected that will be useful in quantifying sales. For example, the average number of posts for sale per month is an obvious input to market size. Less obvious, perhaps, is whether prices are included in the post. The following chart provides some of these comparisons:

These are just some of the many factors relevant to our analysis. To quantify the market takes a lot more data, a lot more assumptions and a lot more work. The following is our attempt to diagram the entire methodology, including the starting data inputs and how we arrived at each number.

Almost all of the data inputs (the boxes with numbers in them) are based on estimates and assumptions.

A. Total Pairs Listed For Sale: This is the most straight forward part of the analysis. We took a minimum of 50-post and 30-day samples for each IG account to determine the best estimate of actual number of posts per sale, and average number of shoes per post.

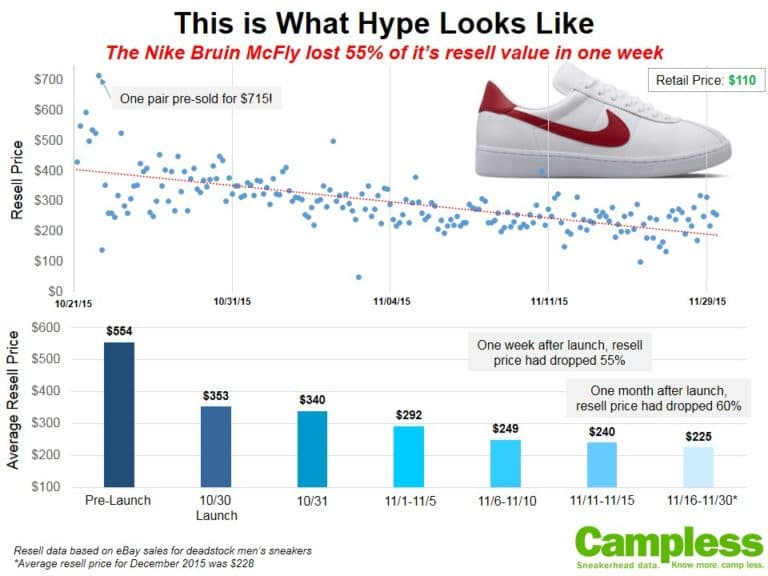

B. Total Dollars Sold: There are three very important data input assumptions here: 1) Relist % (number of times a sneaker gets posted before it’s eventually sold); 2) Sell Through % (percentage of shoes which eventually get sold); and 3) Average Selling Price. Number 1 was calculated from sampling actual posts. Number 2 was estimated by speaking with numerous account owners. Number 3 was calculated by a combination of sampling actual posts and comparison with previous work. For an example of previous work, the average selling price for a pair of sneakers across all of eBay is $133; the average eBay selling price for sneakers tracked by Campless is $238.

C. Classification as an “Instagram Sale”: This is directly related to the four types of accounts and from where their sales come. Listing Accounts and IG Resellers are pure Instagram sales – 100% of their dollars get classified as part of the Instagram market. Marketing Accounts are the farthest away from an Instagram sale – their purpose is marketing; not sales. However, some Marketing Accounts do list individual shoes with prices. For these accounts we chose to allocate 50% of their sales to Instagram. The hardest to classify are IG-Web Resellers, so we made a simple rule: If prices are included, 100% is allocated. If prices are not included, 50% is allocated. Is this an over-simplification of an immensely complicated question? Absolutely. But it feels right and errs on the side of inclusion, while recognizing that many sales are the function of other channels.

D. Percentage of Total Instagram Market: This is by far the most difficult and most important input. We spent a LOT of time trying to identify every single meaningful resell account. We identified 145. There is no way we got them all. We’ve estimated these 145 accounts to make up 40% of the U.S. market based on what we know about the consolidation of seller accounts on eBay and Facebook. Obviously, to the extent we are wrong here, it could have a significant impact on the market size. For example, all other inputs being equal, if these 145 accounts represent 20% of the market, instead of 40%, it would double the market estimate. On the other hand, the 80/20 rule might apply here – i.e., 80% of sales come from 20% of the accounts – suggesting that we are being conservative at 40%.

QUANTIFICATION

With that as way more detail than you probably wanted, we finally arrive at the market estimate:

As mentioned above, minor changes in key assumptions can have significant impact on market size. Our best estimate is $118 million a year, but it doesn’t take much to envision a scenario where the market is only $59 million. On the other hand, it could easily be as high as $215 million.

What do you think? Does $118 million feel right? Which data inputs are too high or too low?

ACCOUNTS ANALYZED

The below chart lists the 145 accounts we analyzed. Keep in mind we only included sneakerhead accounts which, in some way, drive resell sneaker sales. Retail boutiques like UNDFTD or retail designers like Ronnie Fieg were therefore excluded.

To the extent you believe we misclassified any of these accounts, please understand that many were debatable. There is a thin line between an IG Reseller and an IG-Web Reseller, particularly for those with bare-bones websites clearly developed for the sole purpose of consummating Instagram transactions. This scenario was usually classified as an IG Reseller, even though most accounts which included a website were classified as IG-Web Resellers. The difficulty continued from there – we’ll spare you the details – but suffice it to say we spent a lot of time examining each account to ensure that each was classified to the best of our ability, and consistent with all others.

SHOUT OUT

Huge shout out and thanks for Andrew Lin and Dan Doan for their tedious but absolutely critical work in helping to identify, classify and quantify the 145 resell accounts.