The resell market is as strong as it’s ever been, but the one question we get the most these day is:

Are Retro Jordans dying?

The short answer: No.

Resell is fine. Retail is fine.

But there are cracks in the armor.

Retro Jordans have been as synonymous with the resell market as Batman & Robin. Stockton & Malone. Turner & Hooch.

The hypothesis has always been that the retail success of Jordans is premised on a strong resell market. Is it a coincidence that the recent news of adidas rising stock price (at the expense of Nike) is at least somewhat correlated with adidas rising share of the resell market (at the expense of Nike)? At one point, Nike, including Jordan Brand, accounted for 96% of the resell market. That number has dropped consistently and considerably since February 2015 – when adidas launched the Yeezy. Since then adidas has taken share of the resell market with every release. Kanye is this generations’ Jordan. There. I said it.

But this isn’t an analysis of adidas. That will come later. Because despite the rapid resell growth of the brand with three stripes, adidas is still a distant second to Nike. The majority of the resell dollars spent on any given day are still the latest Retro Jordan drop. But if the trends we’ve seen over the last 16 months continue, that may not be the case for long.

Jordan Brand has had a rough time on the resell circuit lately. In 2015, for the first time in a very, very long time, we saw some Retro Jordans sit, with a few even landing on clearance. So far during 2016 they’ve appeared to pull back from the edge – a few big shoes will make it feel like that – but on the whole the Jordan resell game has continued the decline started in 2015, and may be headed for more clearance racks than we’ve seen since the mid 2000’s.

*NOTE: All data in this article is through April 2016.

2015 Holiday Releases Were Horrible

The following chart shows the last four releases of the year for 2014 vs. 2015, and the amount of money resellers made on eBay in December of each year on those four shoes.

Resell profits dropped 70%. And if you ask resellers, they’d say that Nike took 70% of their profits.

These should be huge, instant sell-outs which also command big dollars on the secondary market. The Black Friday release, the Aqua 8, is still showing up at Nike outlets across the country, six months later. This was a monster OG shoe. The 2007 Aqua 8 release was reselling for $450 before this drop; this was a can’t miss. Instead, Nike missed. Besides the inexplicable color change of the heel from black to grey, they clearly released WAY too many pairs. When you combine that with rising retail prices, the money that resellers can make from GR Jordans is disappearing.

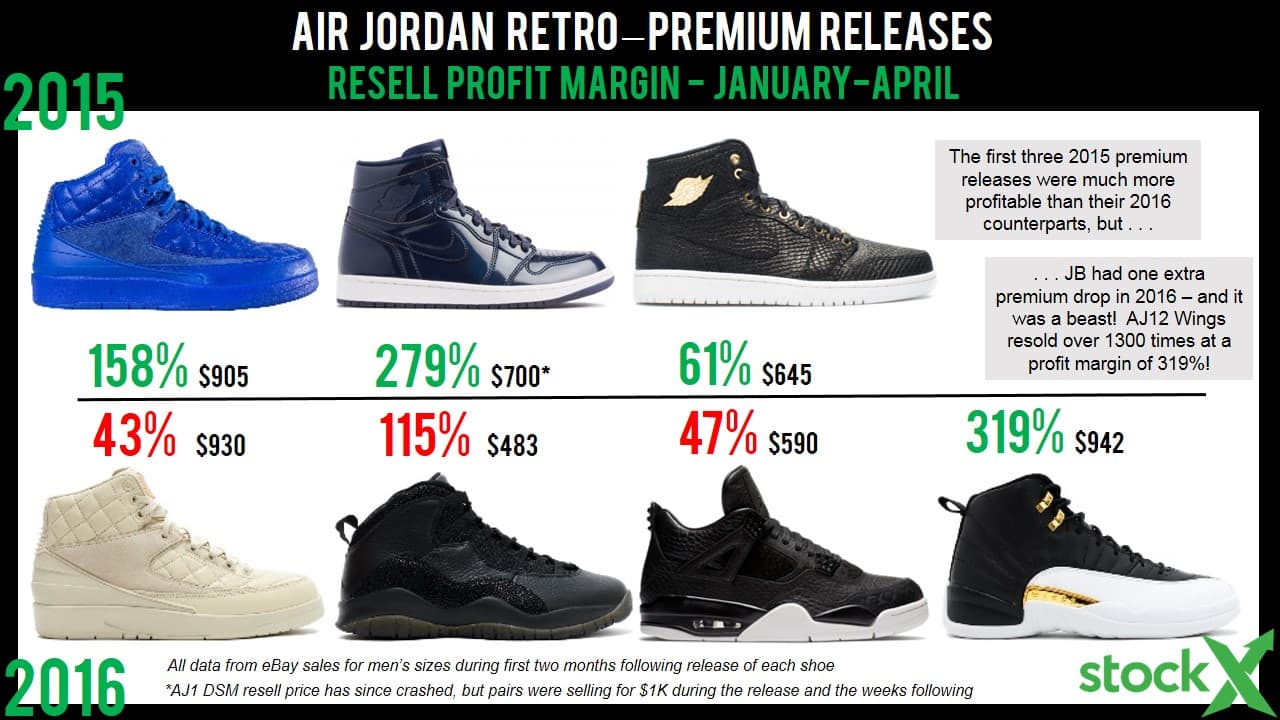

Profit Margin Has Been Declining For Years

It’s not just the last four releases. Resell profit margin* has been declining for the last four years.

*NOTE: Resell Profit Margin is calculated using eBay sales for men size sneakers which occur during the two months following that sneakers’ release. The formula is: Resell Profit Margin = ((Resell Price – Retail Price) / Retail Price)

The following chart shows that resell profit margins on GR Jordans, which was almost 60% at the end of 2011, has fallen to less than 40% in four years.

To understand why declining resell profit margin is so important, let’s do a quick recap on the macro economics of the resell market.

Resell Market Overview

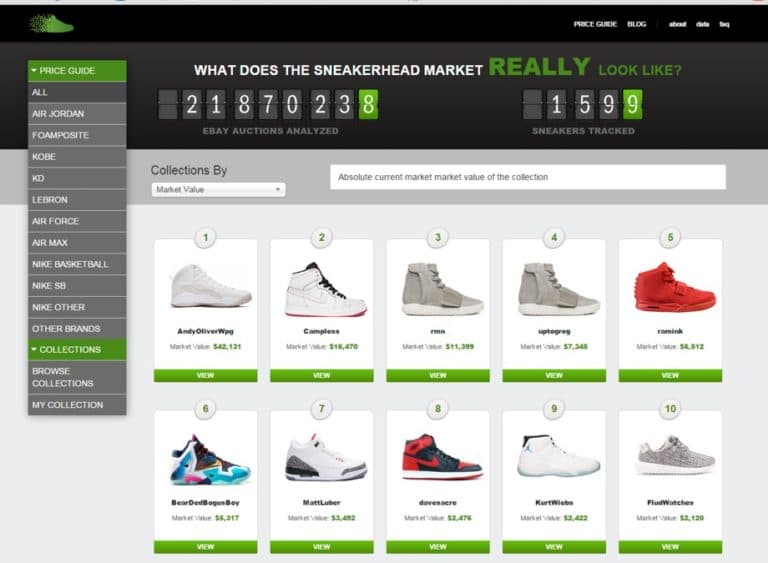

For Nike, and any brand that releases limited-edition sneakers, there are no shortage of ways to use the resell market. We’ve gone deep on this topic before.

In August of 2014, back when we were still known as Campless, we published “An inquiry into the nature and cause of Nike’s wealth at the dawn of sneakerhead nation imperialism . . . or . . . Can Nike get that resell cash?” An intentionally long and pompous title, this was our attempt to take everything we had learned to date – all the data, all the blog posts, all the insights – and at least frame the most complicated question in the sneaker industry: How does Nike leverage the secondary market for its own benefit?

On one hand, it’s a way to ensure sell-outs at retail. On the other, it’s marketing. It’s a sliding scale between the two, but no matter the tactics or the goals, one thing has to exist: a resell premium. The shoe must sell for more on the secondary market than at retail. But how much more?

Keep in mind these are RETAIL companies. Their primary business is to sell RETAIL products. Producing limited-release sneakers is, by definition, antithetical to the company’s goals. To engage in the limited-release strategy, then, takes careful planning. The ideal state for sneaker executives is to produce (and sell) as many pairs as possible, but to keep supply just less than demand.

As long as demand is greater than supply, the resell premium will exist, right?

Well . . . kinda.

Large sneaker brands – like any other big company – have growth targets. There are only two ways to grow a retail business: increase price or volume. For Jordan Brand, that means either increasing the retail price of Retro Jordans, or producing more Retro Jordans . . . or both.

So it should come as no surprise that Jordan Brand has raised retail prices and increased supply for five straight years. It’s been a not-so-subtle attempt to “get that resell cash”.

When Nike sees big resell profit being made by its customers, it seems logical that they can “take” some of that profit, so long as they leave some behind. That logic is sound. The question is how much to leave behind. The issue is the cost of reselling.

One-Third of Jordans are Worthless

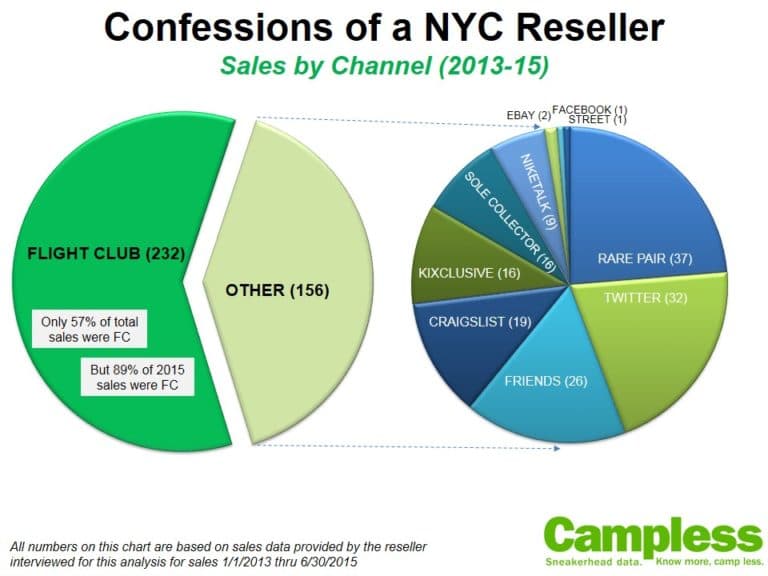

Average reselling costs are 18%: Transaction Fee 10%; Payment Processing 3%; Shipping 5%.*

*NOTE: Yes, there are many places that you can sell for more or less than 18%. Consignment is usually 20% plus shipping if you’re mailing your kicks to the store. Facebook, Twitter and Instagram, for example, have no fees. But eBay still accounts for over 1/3 of the entire market, StockX is the fastest growing new market, and pretty much every other new sneaker market also charges a transaction fee around 10%.

So if reselling costs are 18%, then brands should use that number when deciding how much profit to take, and how much to leave behind – but it doesn’t seem like they do.

In 2015, Jordan Brand dropped 38 general release Retro Jordans. All but one (Jordan 9 Anthracite) sold for more on eBay than at retail. From Nike’s perspective, they were 37 for 38.

But when you consider 18% reselling costs . . .

This chart shows that 12 of the 38 GR Retro Jordans had a resell margin of 18% or less. That means that one-third of all Jordans were essentially worthless to resellers.

Nike didn’t go 37 for 38. They went 26 for 38. That’s a big difference.

Premium Jordan Releases are Increasing

Profit margins are shrinking on GR Jordans. At the same time, the number of premium or high-end Jordan releases has increased.*

*NOTE: We define premium Jordans as any which have a resell profit margin greater than 100%, or a retail price $400 or more.

There were four-times as many high-end Jordan releases in 2015 as there were in 2012.

It’s a shrinking of the middle class.

Gone are the shoes from which resellers could make $100 or $150. Compare these two shoes:

- Jordan 4 Black Cement (11/1/12 release): $160 retail; $270 resell (three months following release); $110 profit; 68% profit margin

- Jordan 4 White Cement (2/13/16 release): $220 retail; $288 resell (three months following release); $68 profit; 31% profit margin

Without this “middle class”, what’s left is either high volume general releases with almost no profit margin, or Quickstrikes that sell for two or three times retail.

Don’t get me wrong – I love OVOs and Don Cs and Doernbechers as much as anyone – they’re great for the game. That’s what drives the hype and the hysteria and gets the whole community fired up, but these are super limited, which means that most people won’t be able to get a pair.

A few resellers with serious connections will make a LOT of money. But your average sneakerhead can’t get a pair. The 15-year old kid trying to fund his collection by reselling can’t get a pair. And more hype from more Quickstrikes obscures the fact that he or she can’t make any money on GRs either. Kids used to be able to buy three pairs and sell two to pay for one – the way so many of us built our collections back in the day. There were 134,000 people who sold at least one pair of sneakers on eBay in 2015 – most resellers aren’t professionals; they’re trying to help fund an expensive habit. But that’s gone – at least, it’s gone for Jordans.

Has 2016 been any better?

2016 Feels Better, But It May Actually Be Worse

Coming off the Flu Game 12 release and an historically great run of Jordan 12s dating back to December (PSNY, PSNY F&F, French Blue, Dynamic Pink GS, Melo GS, The Master, Wings), it feels like we’ve turned the corner on the Jordan resell game . . . but that’s exactly what hype does – it obscures reality. There’s no denying that there have been some great releases over the past few months, resellers are making money again and there is excitement back in the air. But beyond the hype meter, the fall-off is greater than it’s ever been.

*NOTE: All data for 2016 is through April. Therefore, all comparison data to 2015 is also for the first third of the year (Jan-Apr).

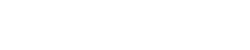

Here’s a side-by-side comparison of the top six most profitable Jordan releases during the first third of the year for 2015 and 2016.

2016 looks better. It just does.

With the exception of the Don C Blue, the average sneakerhead would take every one of the top six from 2016 over every one from 2015. And if you’d ask resellers, odds are their initial response would be that 2016 was better for them. But when you take a closer look at the numbers, there is a BIG difference between 2015 and 2016 and, depending on what you value, it’s not clear which was “better”.

Here are the top line numbers:

All of the trends that we saw in 2015 are continuing – lower profit margins, more shoes with profit margin below 18% and more premium releases. The “shrinking of the middle class” that we discussed above is not only continuing, it’s becoming worse! As we’ll see later, even those which are still technically in that middle class are starting to look a lot more like either a premium or worthless shoe.

The following chart compares 2015 vs. 2016 resell profit dollars by looking at four key data points: Total resell profit; resell profit on GR pairs; resell profit on top pairs; and unprofitable releases. The last three data points are effectively a view into distribution of profit. The two areas we will discuss, then, are: Total Resell Profit and Distribution of Resell Profit.

Total Resell Profit

In terms of total profit, 2016 had significantly more – $2.5M to $1.4M. That’s an increase of $1.1M, or 79%!

But take a closer look and you’ll see that the the Jordan 12 Wings – which accounted for almost $1M of profit alone ($968K to be exact) – is pretty much responsible for the entire increase in profit.

Basically, all Jordan Brand did was add one premium release – in line with their strategy outlined earlier in this analysis. (See chart: “Premium Air Jordan Retros 2012-2015; Increasing Number of High End Releases”). In 2015 they released three premium Jordans, in 2016 they released four.

2015 Premium Jordan Releases (Jan-Apr):

- Jordan 2 Don C Blue

- Jordan 1 Dover Street Market

- Jordan 1 Pinnacle Black

2016 Premium Jordan Releases (Jan-Apr):

- Jordan 2 Don C Beach

- Jordan 10 OVO Black

- Jordan 4 Pony Hair

- Jordan 12 Wings

At first glance, you’d probably think 2016 is stronger. It’s likely that thought is driven by what you know about the Jordan 1 DSM today – i.e., it’s a $350 shoe. In fact, there are seven Asks on StockX (at time of writing) for DSM1s for less than $350. But ask any reseller who was flipping DSMs during release, and they likely made a killing. Some pairs sold for over $1000! So when you look at the same list with numbers, it’s not such an easy call:

2015 Premium Jordan Releases (Jan-Apr) + average resell price / profit margin during that time

- Jordan 2 Don C Blue – $905 / 158%

- Jordan 1 Dover Street Market – $700 / 279%

- Jordan 1 Pinnacle Black – $645 / 61%

2016 Premium Jordan Releases (Jan-Apr) + average resell price / profit margin during that time

- Jordan 2 Don C Beach – $930 / 43%

- Jordan 10 OVO Black – $483 / 115%

- Jordan 4 Pony Hair – $590 / 47%

- Jordan 12 Wings – $942 / 319%

If you take away the Jordan 12 Wings, it’d be no contest, right? Every 2015 release sold for a higher average price and higher profit margin than did its 2016 counterpart.

But the Jordan 12 Wings had a 319% profit margin! Even more importantly, over 1300 pairs were sold on eBay in the two months following it’s release.

On the other hand, let’s remember that your average 15-year old kid trying to build his collection isn’t likely to be able to get a pair of Wings. If there was ever an argument that professional resellers are ‘ruining the game’, this would be it – although we don’t see it that way. We think the issue is that Jordan Brand has basically eviscerated any potential for resell profit on all other Jordans.

Flu Game Caveat: To whatever extent this statement may have already been invalidated by the success of the Flu Game 12, our review of the data so far (through May 30, 2016) is that resell profit margin on the Flu Game 12 is almost identical to the resell profit margin on the Jordan 7 Hare – last May’s big Jordan release. That’s what an OG Retro does. The problem is that the OG Retros are finite. As much as JB would love to, they can only release so many OGs each year. The true test of success is how well they do with new colorways. This year the Jordan 12 The Master was a monster (see details below), but there were many more which were complete flops (AJ2 Alternate 87, AJ9 Low Snakeskin, AJ5 Low Fire Red, etc.). That’s not to say that these aren’t nice shoes – if you like ’em, you should rock ’em. But the data shows that these have almost no resell profit potential, and almost no sneakerhead significance. This has led to a very skewed distribution – many bad, some great, and almost none in the middle.

Distribution of Resell Profit

Referring back to the chart comparing 2015 and 2016 resell profit dollars, we can see that once we isolate down to just general release Jordans, the total profit dollars are almost identical: $1.1M for 2015; $1.2M for 2016. The one key difference was simply the addition of one more premium release (AJ12 Wings).

When we take a deeper look at GR pairs we can see that even though the total profit dollars are the same, the distribution of those profit dollars couldn’t be more different.

Increasing at the Top:

- In 2015, the top six sneakers accounted for 65% of resell profit. In 2016, the top TWO pairs accounted for 65%

- In 2015, there were NO sneakers with more than $200K in profit dollars. In 2016, there were three, including two over $650K.

- In addition to the Jordan 12 Wings, the other big anomaly which drove disparity in profit distribution was the Jordan 12 The Master. This was technically a GR shoe, and a new colorway at that, but it hit the market in just the right way – over 5500 pairs resold at an average price of $308. That’s a 62% profit margin, leading to $658K in total profit dollars. This was a GR shoe that performed like a premium. In fact, the AJ12 Master accounted for more profit dollars than all three of the 2015 premium Jordans combined.

Increasing at the Bottom:

- In 2015, there were only 4 sneakers with a profit margin less than 18%. In 2016, there were 11.

- In 2015, there were only 2 sneakers (10% of total) with less than $5500 in total profit dollars. In 2016, there were 13 (57% of total).

And here’s the key. The premise is the shrinking of the ‘middle class’ so…

Decreasing in the Middle:

- In 2015, there were 18 sneakers with between $5500 and $200K profit dollars. In 2016, there were 7.

- In 2015, there were NO sneakers with negative resell profit margin. In 2016, there were 5.

- In 2015, there were 10 sneakers with a resell profit margin between 18-37%. In 2016, there were 4.

Here’s what it looks like in it’s most simple form:

In short, there was more resell profit in 2016, but it was concentrated in fewer sneakers.

Is this a good thing? Is this a bad thing?

That depends on which side of the business you stand on. Except it’s not ‘sides’, is it? It’s more like a circle, with everyone having a slightly different view of the market depending on what your angle is.

- If you’re a reseller, there are fewer shoes available from which you can make any money. But if you are able to get in on the cash cows, there is plenty of money to be made. We think this favors the professional reseller at the expense of the collection-builder, but that may not necessarily be the case. 15-year olds will always have a lower time value of money and can therefore camp-out or spend the time to figure out how to acquire one or two pairs.

- If you’re Nike or Jordan Brand, you should expect hype around the big releases (and market, in general) to continue growing, but more GR pairs to sit on shelves and hit outlets. Each release is another – and separate – opportunity to play the resell game. You shouldn’t expect hype around the Jordan 12 Wings to cause sneakerheads to rock the Jordan 2 Radio Raheem.

- If you’re an investor who cares of the impact of the resell market on retail, this may be bad news. JB has reached a saturation point with the increase of price and volume on individual shoes, so the best path to growth would seem to be sell-out more releases, but it looks like JB is heading in the other direction. That said, I’m not putting my money against the Retro Jordan machine. I’m betting they figure it out before it’s too late

- If you’re adidas you’ve watched Nike run the limited-release strategy for 30 years, you finally learned how to apply it to your business, and then you watch as Nike forgets what to do. Seize the moment. If you can become the brand that 15-year old kids build their collections on, you may be able to retain some of the resell market share when JB finally gets back to its roots.

- And if you’re a person who loves sneakers and just wants to cop a pair at retail without any hassle . . . what rock have you been living under for the past five years? That’s not the world we live in anymore. But you can expect more Jordans to be available for retail (or less) than ever before – just not OG pairs or the few super-hyped ones you’ll read about in blogs.

Of course, that’s just my opinion. I could be wrong.