As one door closes, another one opens. Instead of slamming the door on 2020 and never looking back, there are some interesting moments that happened in sneakers that are worth reflecting on. Looking back over the past 12 months, it’s been an eventful year. SB Dunk prices rose to stratospheric highs; The Last Dance led to a Jordan Brand buying frenzy; and smaller brands like New Balance and Crocs ascended to the highest levels of hype.

Throughout the year, we have been analysing our resale data to uncover the most interesting stories in sneakers, and to arm buyers and sellers with the most accurate and actionable information. But if you missed out on all the fun, not to worry. In this piece, we’ve assembled some highlights from our analysis to help put the year into perspective.

Here are the 8 charts that explain sneakers in 2020:

1. The Jordan 1 Swoosh Effect

In 2020, we saw an incredible number of Jordan 1s experience huge gains in resale value. It wasn’t just the big, flashy collabs: numerous Jordan 1s saw their values climb from barely above retail to resale royalty almost overnight. This chart shows how much Jordan 1s appreciate over time. We gathered the current resale prices of the top 50 most popular Jordan 1 releases on StockX and compared them to their release-week resale averages. We then calculated how many days the sneaker has been on the market. The resulting chart shows the relationship between price appreciation and time. Each dot represents a different release, and the outliers are noted with images of the sneaker.

Notice how before the 125-day mark, Jordan 1 resale prices hold steady, bobbing right around their baseline release price. Then, as each release ages past four months, we start to notice significant price increases. This pattern can be explained by what we call the “Swoosh Effect.” Typically in the first months after a release, supply floods the market, and resale prices hold steady or even dip. Then, as more pairs are sold and leave the market, supply diminishes and increasing demand pushes resale prices higher. On a chart, it looks like a Swoosh. And in 2020, when demand for Jordans peaked, we saw the Swoosh Effect accelerate across the Jordan 1 market.

2. Jordan 5s: Zero to Hero

Unlike Jordan 1s and 11s, the Jordan 5 has never garnered a reputation in the resale market as a super-profitable silhouette. But in 2020, it became clear that Jordan fans found the silhouette more valuable than ever before. The chart above shows how the average price premium of Jordan 5s has risen over the years. In 2018, price premiums hit a StockX historic low at just 18%. Then in 2020, Jordan 5 resale values bounced back and premiums more than tripled. The average AJ5 now sells at a 54% premium with the help of big releases like the Jordan 5 Off-White and Jordan 5 Trophy Room driving increases in value.

3. Collaboration Is Key

If it wasn’t obvious before, 2020 reaffirmed that collaboration is still the engine of the sneaker game, with the power to transform ordinary brands into vanguards of hype. This year, no one proved this more than New Balance – and in particular, the 992 silhouette. This chart shows the average resale value of each New Balance silhouette at two points in time: the first quarter of 2020 and July 2020. Ever since making a return, the New Balance 992 has been the standout silhouette in the New Balance category. It was the most valuable NB silhouette on StockX all year, but in July, the price gap between the 992 and the next most valuable model wasn’t even close. New Balance 992s went from selling just above retail to an astronomical price just under £400.

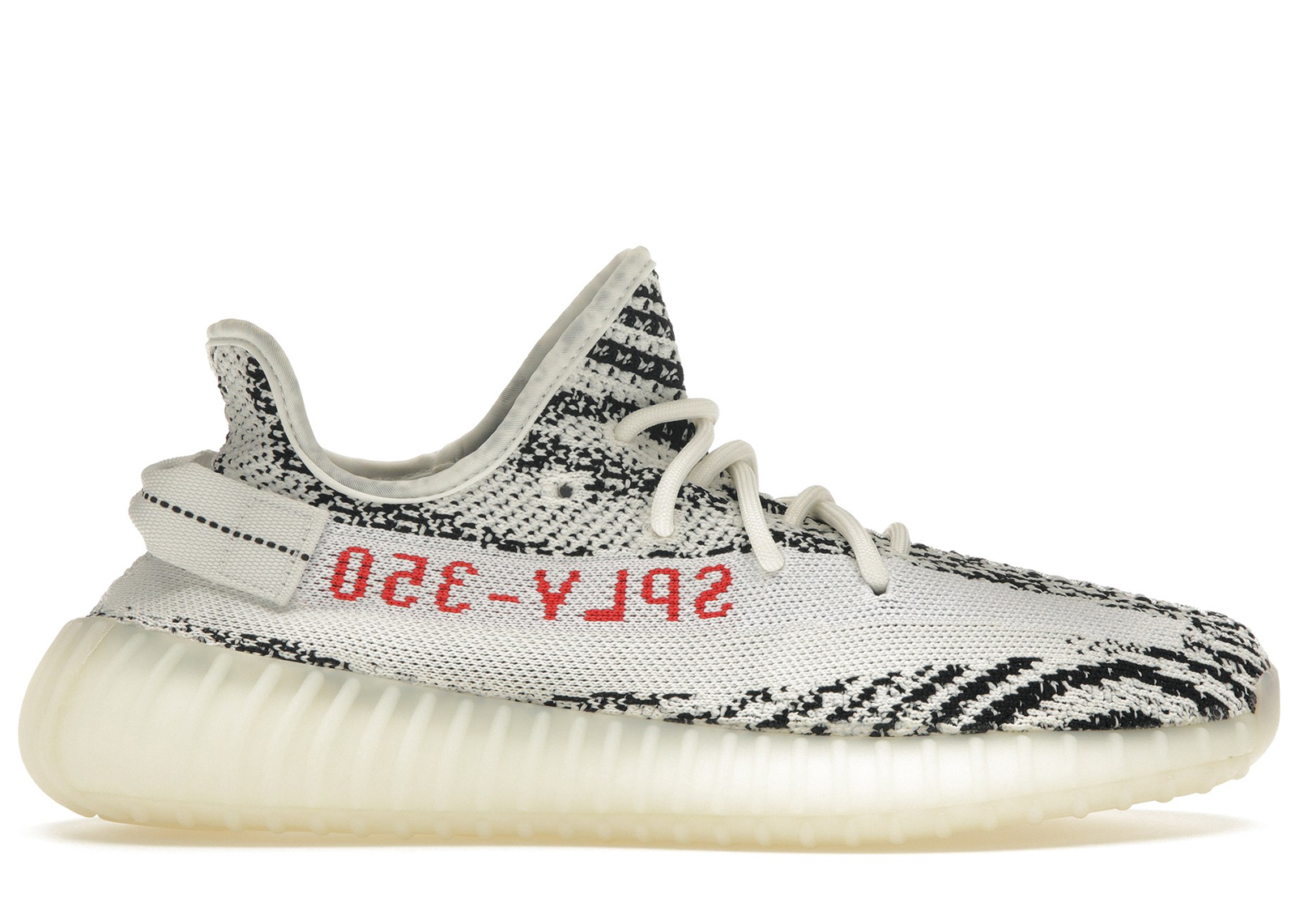

4. The Yeezy Restock Effect

The December restock of the Yeezy 350 V2 Black Red showed, once again, how restocks can tank resale prices. News of an initial restock can have a devastating effect on prices, as the anticipation of new supply undermines value. But there is some good news for repeat restocks: they aren’t as severe. The chart above shows the average price depreciation of primary and secondary Yeezy restocks. Across all the models in our sample, primary results resulted in a 29% decline in average resale price. But secondary restocks (which include both 2nd and 3rd restocks of the same colourway) result in a median price decline of just 17%. So, if and when the Bred 350 restocks for a second time, chances are that prices won’t fall quite so far.

5. Air Forces To Be Reckoned With

Much like the year before it, 2020 belonged to Travis Scott. But while all eyes were on his collaborations with brands like McDonald’s and PlayStation, many of his sneakers were seeing enormous gains in resale value. This chart shows the 1-year increase in resale value for a variety of Travis Scott sneakers. As it turns out, it wasn’t his £1000+ Jordan 1 High that saw the biggest gains. That honour belonged to his Air Force 1s, which were the fastest-appreciating Travis Scott silhouette on the market – at least after one year. Travis AF1 releases climbed by over £175 on average in the year following their release, and his Air Force 1 Sail gained over £360 in resale value.

6. The SB Dunk Bubble

From Ben & Jerry’s and The Grateful Dead setting resale records with their collaborative Dunks to Kylie Jenner flicking up in Ferris Bueller SB Dunk Highs from 2008, Nike SB Dunks saw a full-on resurgence in 2020. SB Dunks new and old are appreciating at a lightning-fast rate. The only event in question has been the sustainability of this bull market. The first half of the year was like a rocketship. Every SB Dunk spiked in value and reached unchartered territory, like the Nike SB Dunk Low Paris which sold for over £38,000. Then, as the year progressed, prices returned to earth. A mixture of consistent SB releases adding more supply to the market and a decrease in demand from extremely high prices have readjusted the true market price for the average SB Dunk. While prices may be lower than what they once were, an average resale price of nearly £300 for a shoe that retails at under £100 is still very impressive.

7. Crocs And Music

New Balance isn’t the only emerging brand that has used the power of collaboration to grow exponentially on StockX. This year, Crocs has been a breakout star with the help of their unexpected collabs. In December of 2019, a collab with Post Malone introduced the resale world to Crocs. Then in 2020, Crocs teamed up with musicians like Bad Bunny, Justin Bieber, and The Grateful Dead to help increase sales on StockX by over 750%.

8. The Last Dance Effect

In 2020, the biggest event in sports and sneakers wasn’t a game or a product launch: it was a documentary. Jordan Brand was already having a strong year even before Netflix aired The Last Dance in April. But after the documentary aired, Jordan sales and prices went through the roof. Just how much did The Last Dance affect resale prices? For the chart above, we constructed an index of the top 100 best-selling older Jordan models on StockX, and tracked how their resale prices fluctuated over time. As you can see, the average price of this Jordan 100 index was flat for the first three months of the year. But in April, when The Last Dance aired, prices on older Jordans started rising across the board. Prices continued to climb over the summer, rising by as much as 50% on average. It isn’t an exaggeration to say that this one documentary added tens of millions of pounds to the sneaker resale market- pretty good for basic cable.