Bestselling Brands

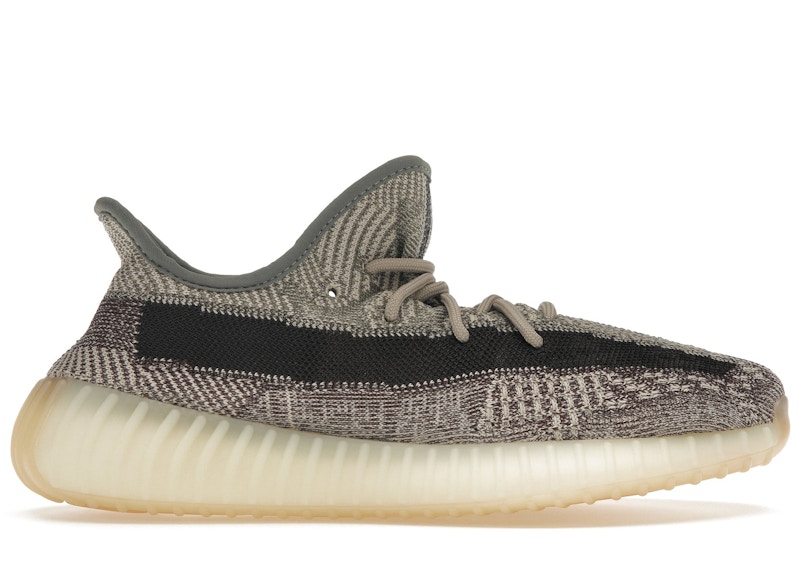

With a string of big-hitting releases under their belts, Jordan and Nike dominated the European buyer market for July. Adidas was the only other brand to post double-digit numbers, primarily driven by the Yeezy 350 v2 “Zyon”.

Converse trailed in a distant fourth, mainly driven by a strong showing in France (more on that to come), while New Balance’s growing success in the US hasn’t translated to Europe just yet.

While hyped releases did the business for Jumpman and adidas, interestingly it was the ever-dependable Air Force 1 that drove the highest volume of sales for Nike in Europe. Top of the list was the customisable “Tear-Away” White and Sail editions, closely followed by the Air Force 1 Low “South Korea” (2020) and the classic Air Force 1 Low White ’07 edition.

Customers were no doubt attracted to the lower price points for this silhouette, with the White ’07 going for as low as just £65 last month. A reminder again that StockX is a great resource for under-retail steals.

Bestselling Sneakers

When it comes to specific silhouettes, it was another month dominated by Jordan brand. Jordan may have played ball in Chicago, but The Last Dance documentary chronicling his career was watched around the world, and just like their American counterparts, European buyers have continued to flock to the Jumpman brand. The power of Jordan nostalgia can be seen in the runaway success of the “Smoke Grey” and iconic “Chicago” colourways capturing the hearts and minds of a new wave of Jordan fans.

Interestingly, two of the five biggest sellers last month were Jordan 1 Mids. While the High silhouette continues to lead in popularity, Mids are proving a natural entry point for this audience, and we’ve also seen a big rise in GS sizes being sold. The increased demand for smaller-size sneakers suggests that the Jordan resurgence in Europe is at least partially driven by the growing female sneakerhead market.

The graphic above shows the top 5 highest GMV sneakers of July and their respective market share (calculated as a share of the top 10, not all sneakers sold on StockX during the month).

Another sign of female sneaker power: the Jordan 4 Off-White “Sail”, which ranks among the most hyped women’s exclusive releases in StockX history. Despite only releasing at the tail end of August, the Air Jordan 4 Off-White “Sail” was the 2nd biggest European seller, as measured by GMV. Among the top 10 sneakers purchased in Europe, the Jordan 4 Off-White “Sail” accounted for 15% of the total spend. Meanwhile, the Yeezy 350 v2 “Zyon” was notable for being the only release from adidas to make the top 5.

Country Breakdown

In the UK, the Air Jordan 4 Retro SE “Neon” made the top 5 best-sellers list despite being released all the way back in March. Over in France, we’ve seen huge demand for the “Maison Chateau Rouge” Jordan 1 Mid, while the Converse Run Star Hike Hi also saw strong July sales in this market.

The Jordan takeover continued with the Jordan 1 High “Black Royal Toe” and Jordan 1 High “Tie-Dye” ranking highly in Germany and Italy, respectively, but it was over in The Netherlands where we really saw some local flavour.

A country with a huge Air Max Heritage, both the Orange and Green Nike Air Max 1 “Anniversary” editions were two of the most popular releases last month. Not far behind was the Nike Air Max One “Daisy” – a low-key banger with serious “Chunky Dunky” vibes that had previously gone under the radar for most. With an average sale price of just £136 in July, we’re expecting big things from this silhouette before the summer is out.

Highest Prices and Biggest Premiums

Among European buyers, the sneaker with the biggest price premium in July was the Nike SB Dunk Low Grateful Dead Bears Orange. European buyers paid an average price premium of 3400% above retail for the Orange SB Dunk “Bears”. SB Dunks have been on a worldwide hot streak lately, and the Orange Bears were one of the rarest and most hyped colourways to drop all year, so it’s no surprise to see them rank #1.

For European buyers, the second- and third-highest price premiums paid in July belonged to two Off-White Jordan 1s: the Jordan 1 Retro High Off-White “Chicago”, which had an average price premium of 2210%, and the Jordan 1 Retro High Off-White White, with an average price premium of 1820%. Interestingly, both of these Off-White Jordan 1s tend to sell for more in Europe than in the United States. The fact that two of the most profitable European sneakers this July belong to a single designer – Virgil Abloh – is a testament to the global hype of his Off-White brand.

When it comes to overall resale price, one sneaker stood high above the rest this July: the Jordan 1 Retro High Dior. European buyers paid an average of £9,549 for the Dior Jordan 1 High. They paid £6,920 on average for the Jordan 1 Retro Low Dior, making it the second most expensive sneaker for July buyers. The two Dior Jordans were in a league of their own: no other sneaker boasted resale prices higher than £5,000.