Bestselling Brands

Jumpman continues its European conquest, with Jordan models accounting for more than half of European purchases in September. Read that again: over half of all European buys on StockX last month was a Jordan silhouette.

If you haven’t entered the game already, what are you waiting for? Jordan is on fire right now.

Bestselling Sneakers

The graphic above shows the top 5 highest GMV (Gross Merchandise Value) sneakers of September and their respective market share (calculated as a share of the top 10, not all sneakers sold on StockX).

The graphic above shows the top 5 highest GMV (Gross Merchandise Value) sneakers of September and their respective market share (calculated as a share of the top 10, not all sneakers sold on StockX).

The Air Jordan 1 continues its run as the best-selling silhouette across the continent, but it is a trend that continues to evolve with time. For the first time, the best-selling Jordan 1s were all Highs, with the popular Light Smoke Grey and Chicago Toe Mid colourways tumbling out of the top five. Interestingly, out of the top 3, only the Bio Hack colourway was a new release. The older High Court Purple and Satin Snake colourways never really went away, but both pairs enjoyed especially strong sales in the last month.

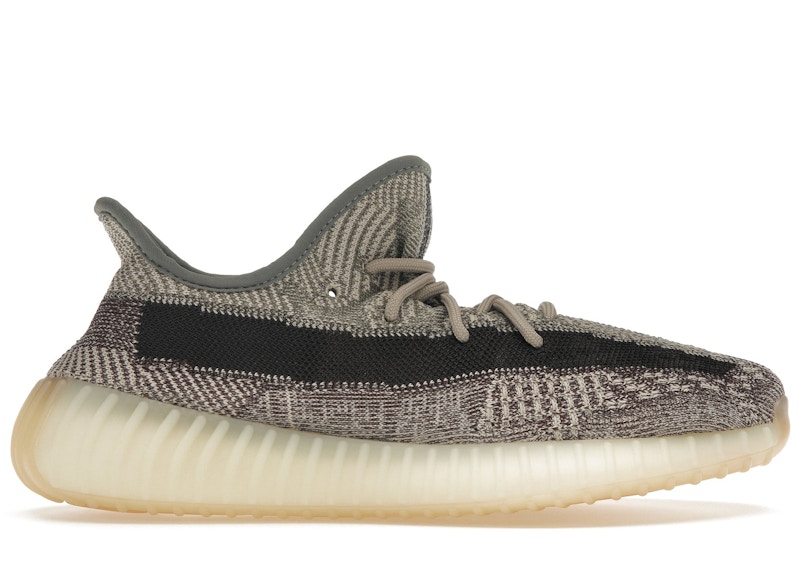

Away from Jordan, the Yeezy Boost v2 Zyon continued to be popular amongst European customers, but it dropped to #4 on our list, after having ranked #2 in August. And while the Nike Dunk Low Lemon Wash only managed to score #5 spot overall, this release commanded the highest fee from the list, with an average sale price of over £340.

Trending Silhouettes

The graphic above shows the % increase in European GMV of respective silhouettes in September compared with GMV from the previous month

The graphic above shows the % increase in European GMV of respective silhouettes in September compared with GMV from the previous month

With a string of popular Dunk Low releases under its belt already in 2020, Nike dropped two brand new Dunk High releases last month, leading to a 1000% increase in European GMV versus the previous month. There were plenty of other silhouettes that enjoyed strong rises over the course of September, too.

Perhaps anticipating more time spent inside as the wet, winter weather approaches, sales of the Yeezy Slide in Europe increased 365% month-on-month. Spurred on by collaborations with Atmos, LEGO, and Prada, the Adidas ZX8000 and Superstar silhouettes both enjoyed increases of 129% and 83% respectively. With much more to come from the adidas AZ-X series this year, it’s well worth keeping an eye out for upcoming ZX releases.

Finally, the Yeezy 700 v3 got in on the action, enjoying a 74% month-on-month sales increase thanks to a strong showing from the Azareth colourway.

Country breakdown

When comparing European country sales data with the rest of the world, we really start to get a sense of which silhouettes have captured hearts and minds on the ground.

We’ll start our tour around Europe in the Netherlands, which, as we’ve mentioned before, has a huge Air Max heritage. Dutch customers were seemingly taken by the Air Max 1 Limeade release, purchasing the sneaker at a massive 24x the global average. We saw similar spikes in Italy and France, with the Air Jordan 1 Satin Snake selling over 12x the global average in Italy. Meanwhile, Converse’s linkup with A Cold Wall was a surprising hit with our French customers, who purchased over 9x the global average of this release.

On a smaller scale, German buyers went in hard on the Nike Dunk Low Lemon Wash, while the Air Jordan 4 Union Guava Ice was a standout release for the UK market.

Most Expensive & Price Premiums

The graphic above shows the most expensive purchases by European users in September

When it comes to the most expensive overall purchase in September, the Air Jordan 1 High Dior continues to set the pace for the third month running since release, with a top sale price of £7,845.

However, when we look at overall price premiums (the % increase between resale and retail price), it was another high-profile Nike collaboration which made the biggest gains.

As we’re sure you know, before jumping ship to adidas, the very first Yeezy silhouettes that Kanye released were in collaboration with Nike. Eight years later and these coveted kicks are still doing big business for sellers lucky enough to have a pair.

Two sales of the Nike Air Yeezy 2 NRG, in Black Solar Red and Pure Platinum colourways, achieved massive 2892% and 2505% price premiums, respectively, both reaching prices upwards of £4,000. Thought the Yeezy hype was a thing of the past? Think again. OG colourways of the 350 and even 350 v2 can still bag a tidy profit for sellers, even if you can’t wait the best part of a decade!