After fourteen years, plus months and weeks of whispers and rumors, word has finally come down from King James himself (via Instagram and Uninterrupted). Nike is finally going to retro LeBron’s first signature sneaker — the Nike Air Zoom Generation.

With this historical announcement, plus anticipation building for the LeBron 14 release, we at StockX felt that it was time for a “State of the LeBron Resell” post.

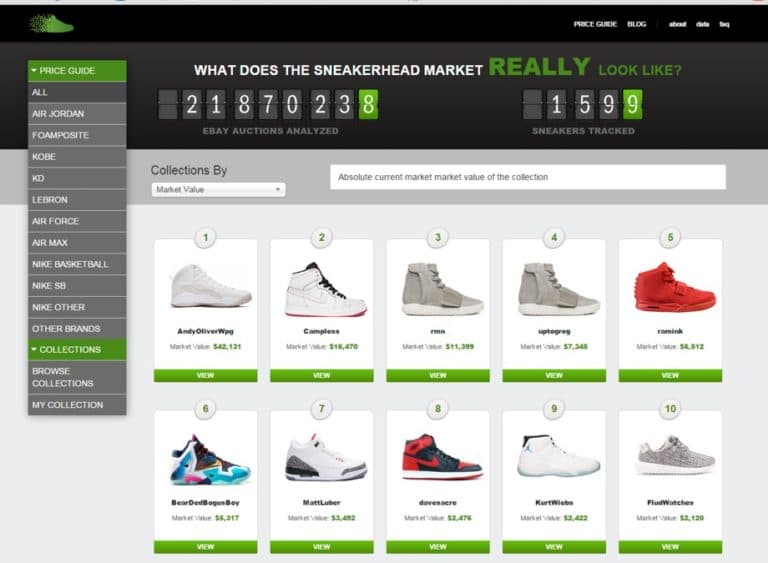

The data below combines the sales history of deadstock LeBron signature sneakers from May 2012 through November 2016 from StockX, sneaker consignment shops and other online marketplaces. Player exclusives are not included.

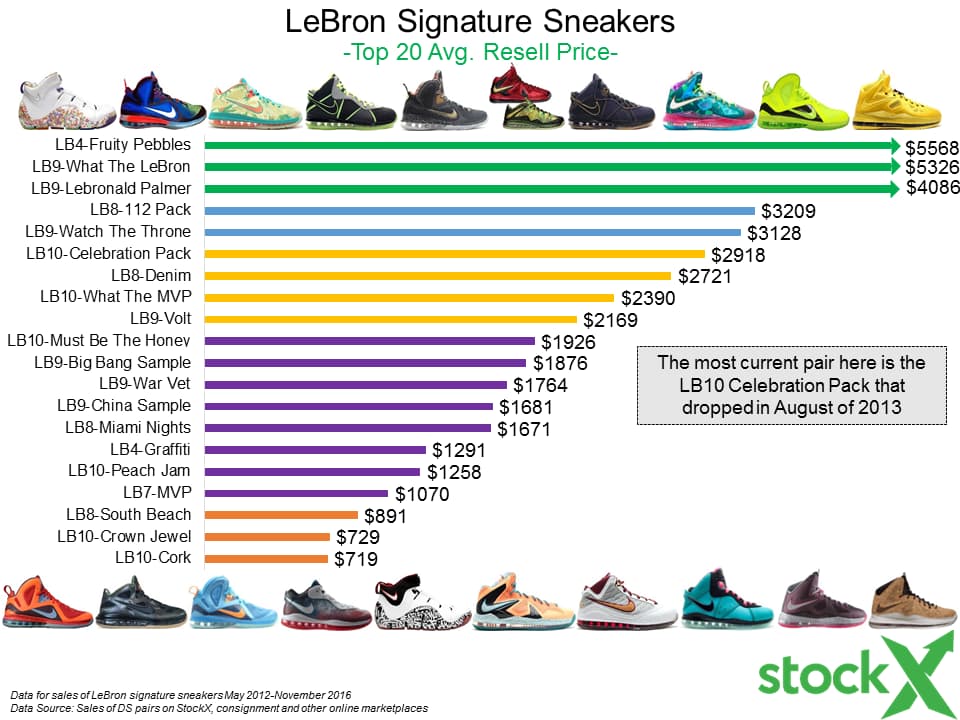

First, the most expensive LeBrons.

Key Insights:

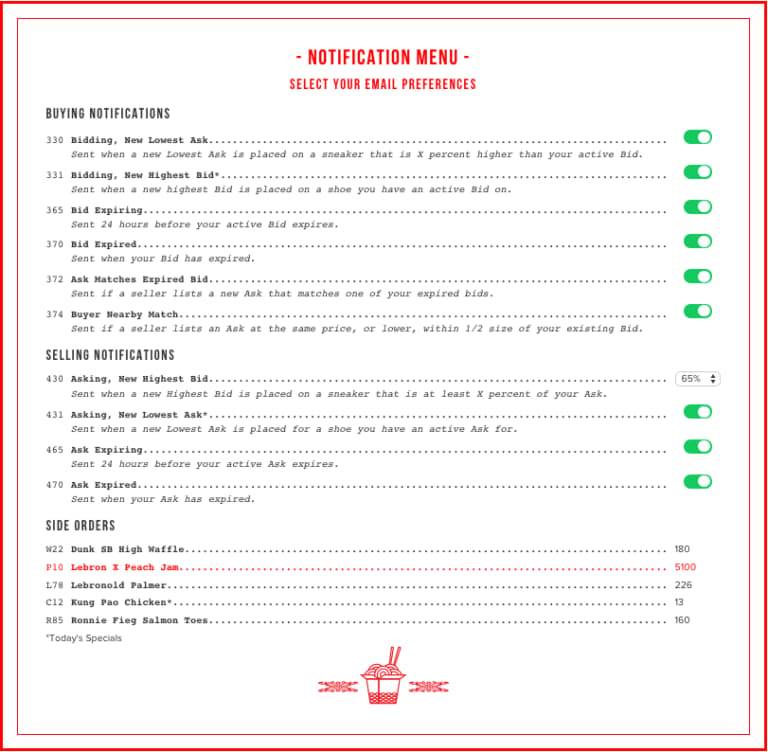

- Historic grails, the LB4 Fruity Pebbles, LB9 What The LeBron and Lebronald Palmers come out way on top.

- The top 20 is comprised entirely of LeBron 4s, 7s, 8s, 9s and 10s. No other model cracks the top 20.

- The most expensive LeBron 13 is the Doernbecher, which ranks #88 with an average resell price of $269.

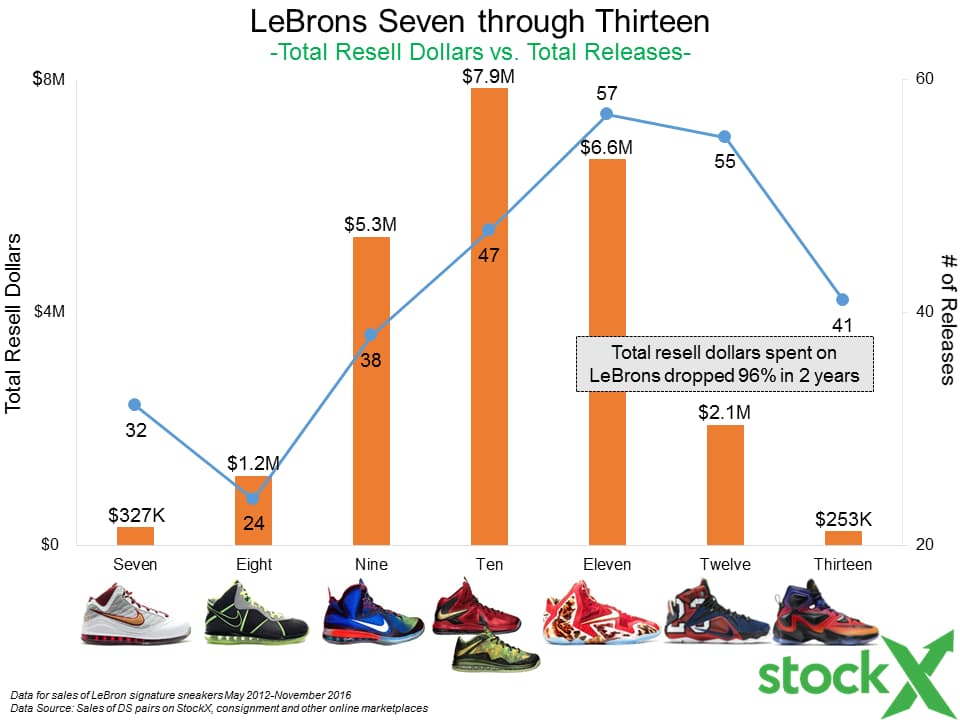

Now, the best selling LeBrons. Key Insights:

Key Insights:

- From May 2012 through November 2016, the total amount of dollars spent on all deadstock LeBrons comes out to just over $24M across all resale channels.

- If you add in used pairs this total increases to $36M.

- There are no LeBron 12s or 13s on this chart and only five pairs of 11s.

Here’s how the resell dollars break down across the most recent models of LeBron’s signature sneakers.

- The massive number of LB10 and LB11 colorways released, 47 and 57 respectively, drive their dominance in total resell dollars.

- The lack of limited releases of the LB12 combined with its high retail price drastically decreased resell activity, which carried over into the LB13.

- Worth noting, the LeBron Fours generated $321K in resell dollars with an average resell price of $464.

- Total resell dollars have been on a steady and sharp decline over the last four models of LeBrons.

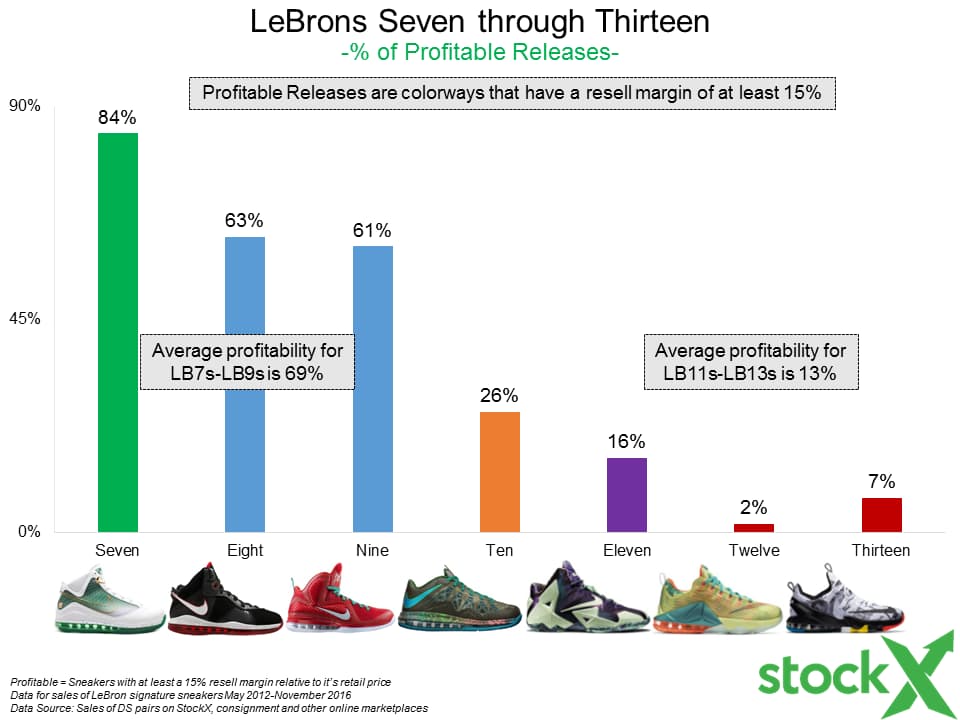

This next chart compares the resell profitability of each LeBron model taking into consideration selling fees and shipping costs. For simplicity, we are defining profitable releases as those colorways that have a resell margin of at least 15% over retail.

Key Insights:

- Profitability Count:

- LB9 (23 of 38) – 61%

- LB10 (12 of 47) – 26%

- LB11 (9 of 57) – 16%

- LB12 (1 of 55) – 2%

- LB13 (3 of 41) – 7%

- This means that there are more profitable LB9s than all profitable LB10s, 11s and 12s combined.

- The 3 pairs of LB13s that are profitable are the Doernbecher in Mens and GS sizes and the Family Foundation.

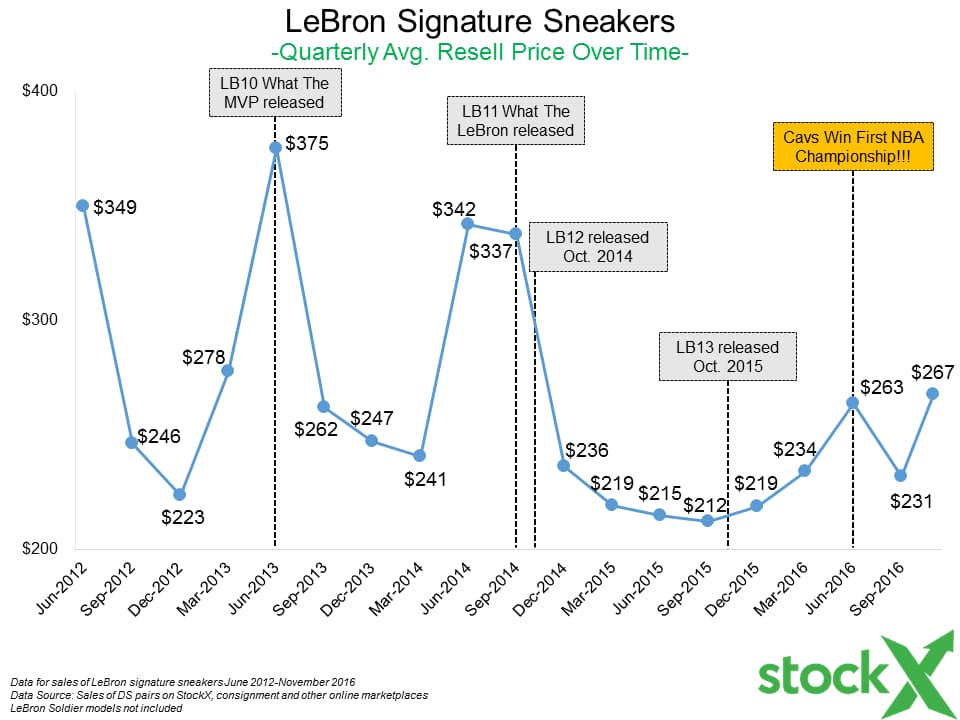

For our last chart, we take a look at the aggregate resell price for ALL LeBrons from June 2012 through November 2016. The data is pretty telling and reflects how the sneaker game has shifted overall in the past couple of years.

- The downward trend in the aggregate price is a reflection of the over saturation in the market of general release LeBrons with fewer and fewer limited colorways released starting with the LB11 as explained in our previous two charts.

- That said, sneakerheads still love anything in a “What The” colorway.

The Future:

The data is clear: recent LeBrons have lost their relevance in the secondary sneaker market. In fact, all Nike Basketball has shifted away from a limited release strategy.

But is that about to change?

Today’s news from LeBron about the retro release of the Air Zoom Generation is one good indicator that this could be the case. The second indicator is the LeBron 14. Initial images show great potential for some amazing colorways. The price point of the LB14 is being re-centered and hopefully, Nike keeps supply lower than in years past.

We envision a future where LeBron’s new (and retro) sneakers will regain the sneakerhead relevance that they’ve lost in the last couple of years.