StockX, the world’s first online consumer “Stock Market of Things,” today announced that it has closed a $6 million round of funding from several high-profile investors. These investors include Mark Wahlberg, Eminem and Paul Rosenberg (previously announced), Ted Leonsis, Steve Case, Tim Armstrong, Scooter Braun, Jon Buscemi, Wale, Joe Haden, DJ Skee, and Silicon Valley investor Ron Conway and his SV Angel fund. Additional investors include Courtside Ventures and Detroit Venture Partners.

“With StockX, we’ve set out to create a unique form of commerce that genuinely doesn’t exist outside the stock market,” said StockX Co-Founder and CEO Josh Luber. “We are fortunate to have a unique group of investors—people who have changed the world in their respective fields and who are already helping us do the same.”

StockX, which was founded by Luber and Dan Gilbert, founder and chairman of Quicken Loans and majority owner of the 2016 NBA Champion Cleveland Cavaliers, is a consumer goods marketplace that connects Buyers and Sellers using a live “Bid/Ask” market—the exact same method used by the world’s stock markets. In less than a year, the company has experienced explosive growth while launching game-changing campaigns in the ecommerce world.

Last month, Nike released LeBron James’ retro sneaker line on StockX as part of the Cavs Court SPO, a StockX Product Offering, which included limited sneakers in a sneaker box made from wood from the Cleveland Cavaliers championship court and a Cavs championship ring. This capped StockX’s first year, which also included the launch of native mobile apps, global expansion, an SPO with Roc-a-Fella records, a charity auction for hip hop artist Ne-Yo, appearances on The Daily Show, SportsCenter, CNBC and NPR, feature articles in The New York Times, Bloomberg and Fortune, and producing a video with Wale and Hasan Minhaj that was nominated for a TechCrunch Crunchies award for best launch video by a startup.

“Working at the dawn of the internet, we could only dream of the transformative changes that would come, but they did: the browser, search, ecommerce, social networking, etc.,” said Ted Leonsis, former President and Vice Chairman of AOL, and current majority owner of the Washington Capitals, Washington Wizards, and Washington Mystics. “This is the power we knew the internet could deliver. This is why I’m investing in StockX. A “Stock Market of Things” has the power to transform both commerce and finance, and we will help however we can.”

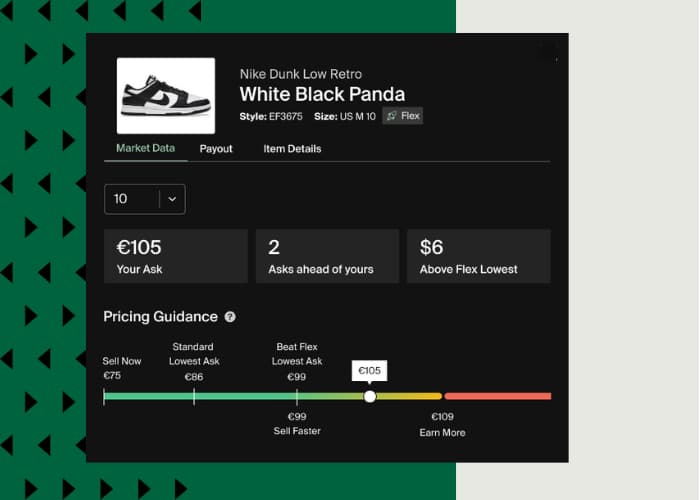

StockX launched in February of 2016 with an initial focus on the $6 billion global sneaker resale market, but the broader goal is to provide a transparent, anonymous, and authentic marketplace for all consumer goods. This funding will help accelerate the expansion to other verticals, including watches and handbags, the launch of more and more innovative SPOs and, of course, continued penetration into the sneaker market.

About StockX

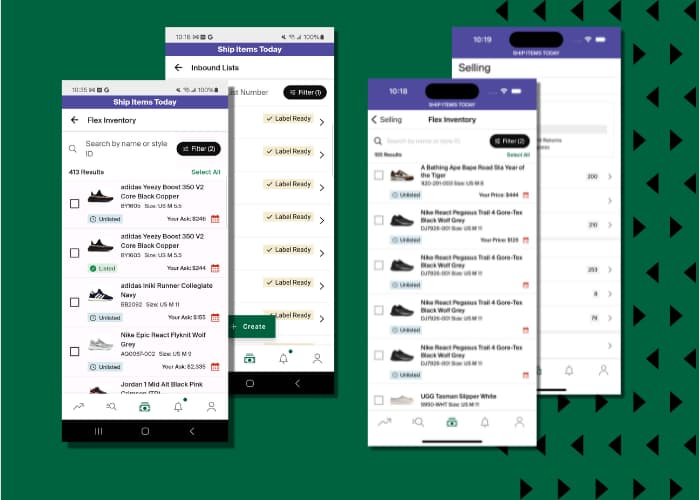

StockX is the world’s first online consumer “Stock Market of Things” for high-demand, limited-edition products. Participants Buy and Sell authenticated products in a live marketplace where they anonymously trade with stock market-like visibility. The StockX exchange offers Buyers and Sellers historical price and volume metrics, real-time Bids and offers (Asks), time-stamped trades, individualized portfolio tracking and metrics, as well as in-depth market analysis and news. StockX launched its inaugural marketplace in the secondary sneaker space with plans to expand to additional consumer product segments that have a natural need for a live secondary market.