2025

2025

2025

2025

Sneakerheads, it’s time to lock in.

With countless colorways and styles, we rounded up the best deals for Women’s Jordan shoes on StockX right now.

Read Now + + + + +

Before buying a pair of Air Jordan 1s, dive into our Buyer's Guide to get familiar with the sneaker's long and colorful history.

Read Now + + + + +

We take a look at some of the best Kobe Bryant shoes from Nike that bring style both on and off the court.

Read Now + + + + +

Nike and Kobe Bryant had a partnership unlike any other. We go into Kobe's sneaker journey and what's next to come from the Swoosh in our Nike Kobe Shoes Buyer's Guide.

Read Now + + + + +

UGG: The Buyer's Guide

The Buyer's Guide: Yeezy Slides

The Buyer's Guide: Yeezy Boost 350 V2

The Buyer's Guide: Vans

The Buyer's Guide: Nike SB Dunk Low

The Buyer's Guide: Nike Dunk Sneakers

The Buyer's Guide: Nike Blazer

The Buyer's Guide: Nike Air Force 1

The Buyer's Guide: Jordan Golf Shoes

The Buyer's Guide: Jordan 1 Sneakers

The Buyer's Guide: Converse Sneakers

The Buyer's Guide: Clarks Shoes

The Buyer's Guide: Chrome Hearts

The Buyer's Guide: Bearbrick

The Buyer's Guide: Alexander McQueen Sneakers

The Buyer's Guide: Air Jordan 4

The Buyer's Guide: Air Jordan 3

The Buyer's Guide: Air Jordan 13

The Buyer's Guide: Air Jordan 11

The Buyer's Guide: adidas Raf Simons

Swatch x Omega Moonswatch: The Buyer’s Guide

On Running: The Buyer's Guide

Moncler: The Buyer's Guide

We dive deeper into the new Jordan 4 Bred Reimagined and the history of this fabled colorway.

Read Now + + + + +From fashion to electronics to music. We're covering all of current culture for you.

Collectibles, Trading Cards, and Electronics Can Now Be Sold on Flex

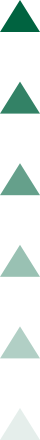

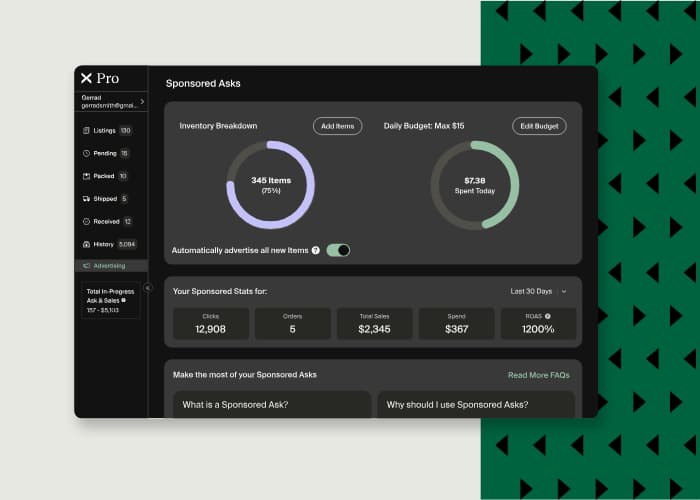

Understanding Return On Ad Spend (ROAS) for Sponsored Asks

The Best Collabs of 2024

StockX Sponsored Asks Are Now Available on iOS

PlayStation 30th Anniversary Collection Now Eligible for Flex

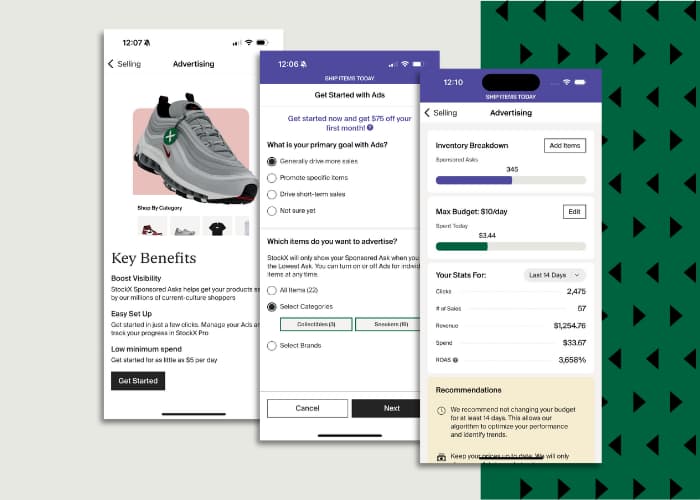

Create Flex Shipments Faster with Barcode Scanning

We’ve compiled a list of our favorite women killing it in the fashion world. These emerging designers are worth having on your radar.

Read Now + + + + +

From BAPE to New Balance, we're taking a look at the best JJJJound collaborations available on StockX.

From BAPE to New Balance, we're taking a look at the best JJJJound collaborations available on StockX.

Read Now + + + + +HEY YOU

You might have noticed that we've been adding electronics to the catalogue, products like Nintendo Switches, PlayStation 5s, and Apple AirPods. Plus there's a lot more coming. We're really excited to share these releases with our readers and invite you to sign up for our newsletter to get the latest news on our expansion.