“Your Sneakers or Your Life” read the May 14, 1990 issue of Sports Illustrated with a cover story on the violence raging through sneaker culture. In the 1990s, magazines and newspapers featured frightening stories of sneaker-induced violence, with special attention paid to Jordans – the first sneaker to create a secondary market. Over time, more and more sneakers became infamous for their chaotic and often violent releases: Nike SB Dunks, Foamposites, and then in the late 2000s, Nike Air Yeezys. During Kanye’s stint with Nike, the Air Yeezy supply was extremely limited. As a result, each release was met with instant sell-outs, untouchable resale prices, and fans who would do whatever it took to get their hands on a pair. Compared to today’s ultra-accessible sneaker market, buying highly coveted shoes used to come with a cost. Customers not only worried about limited quantities and high retail prices, but also their physical safety when returning home with their purchase.

When Kanye left the Swoosh to join adidas in 2014, he made it clear he wanted to leave the stigma of impossible-to-buy Yeezy sneakers in the past. In 2015, he announced on On Air with Ryan Seacrest that the days of ultra-limited Yeezy releases were coming to an end. Of course, nobody wanted to believe it. Yeezys were synonymous with scarcity.

Image by Adidas Originals

There are at least two explanations for why Kanye decided to increase the Yeezy supply. The charitable explanation holds that Kanye was genuinely concerned with accessibility: producing millions of sneakers would democratize access, giving more fans the opportunity to purchase Yeezy shoes at lower prices (retail and resale), and minimizing the violence associated with big releases. A more economic theory is that every dollar resellers make by flipping Yeezys is a dollar Kanye himself forfeits. More Yeezy supply means more money in Kanye’s pocket and that of his billion-dollar brand.

So, in 2015, in order to increase Yeezy supply, Kanye created Yeezy Supply: an e-commerce platform acting as an alternate sales channel whereby fans could cop kicks directly from the Yeezy brand rather than a traditional retailer. Restocks on the Yeezy Supply site have been the primary channel for delivering a fresh supply of existing Yeezys to the market. For those unfamiliar, a restock is when a shoe that has previously been released is re-released in new quantities. As with any market, when you increase the supply of a limited good, prices will go down. So it makes sense that a restock would lower Yeezy prices. But how much?

To answer this, and determine the precise effect that Yeezy Supply restocks have on prices, we analyzed historical resale prices for all major Yeezy restocks over the past four years. These are our findings:

Primary Restocks On Yeezy Supply

For this analysis, we focused exclusively on restocks that occurred via Yeezy Supply, since those are the ones that have significantly impacted prices. While some retailers have been known to restock Yeezys, those lower volumes don’t have much of an impact on the global market. For example, just this month the retailer Sneakersnstuff restocked three Yeezys on their website that were previously sold out: the 350 V2 Yeezreel, 700 V3 Azael, and 380 Mist. Comparing the before-and-after data, we found that average resale prices hardly budged. The price of the 380 Mist declined by precisely $1 in response to the restock. Yes, one whole dollar. The lesson here is that not all restocks are created equal. Despite being a retail powerhouse, SNS carries a much smaller supply of sneakers than the source. Yeezy Supply is the source.

Typically, we found that resale prices start declining around four weeks before a Yeezy Supply restock occurs: once an impending restock is announced (or news leaks), buyers and sellers change their behavior in anticipation of the increased Yeezy. So, for this analysis, we looked at resale prices one month before the restock, and then traced the price trajectory from that point forward.

The line chart above shows the effect on prices for six primary Yeezy restocks (since the same Yeezy model sometimes restocks more than once, so we draw a distinction between a primary and secondary restock). The chart shows how much resale prices respond, week-by-week, as a percentage of the pre-restock average. On the whole, we found that among primary restocks, the median price decline was 29%. In other words, in the immediate aftermath of a primary restock, the typical Yeezy is 29% less valuable than it was four weeks before.

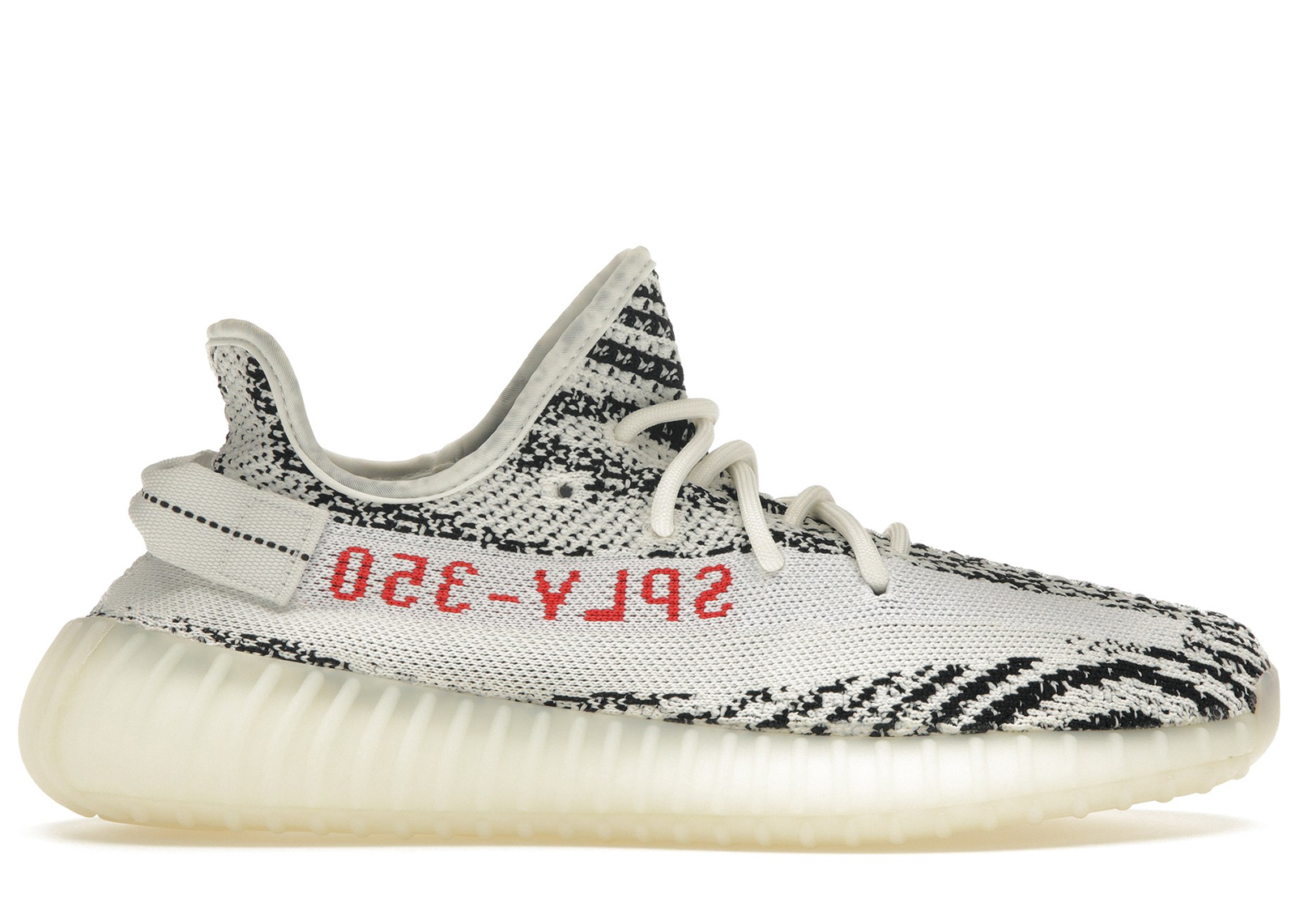

One case that particularly stands out is that of the Yeezy 350 V2 Zebra. The Yeezy 350 V2 Zebra used to be viewed as a profitable, big-ticket item. Four weeks prior to its restock, the Zebra was selling for over $1,200 on StockX and was considered one of the most expensive Yeezys on the market. Then, word of a Yeezy Supply restock broke out. Prices began to plummet and continued on a downward trend for a month leading into the restock. When the Zebras finally restocked, a new market price was set at a mere $556- a spectacular 55% free-fall in just four weeks.

After the restock is over, some Yeezys, like the 350 Cream White, continued to lose value for another couple weeks; others, like the 350 Black, began to bounce back immediately. However, even though prices eventually start increasing again, they rarely ever bounce back to their pre-restock peaks. The only exception is the 350 Black, which took 20 weeks to fully recover its value. For all other primary restocks, the decline was permanent.

Secondary Restocks On Yeezy Supply

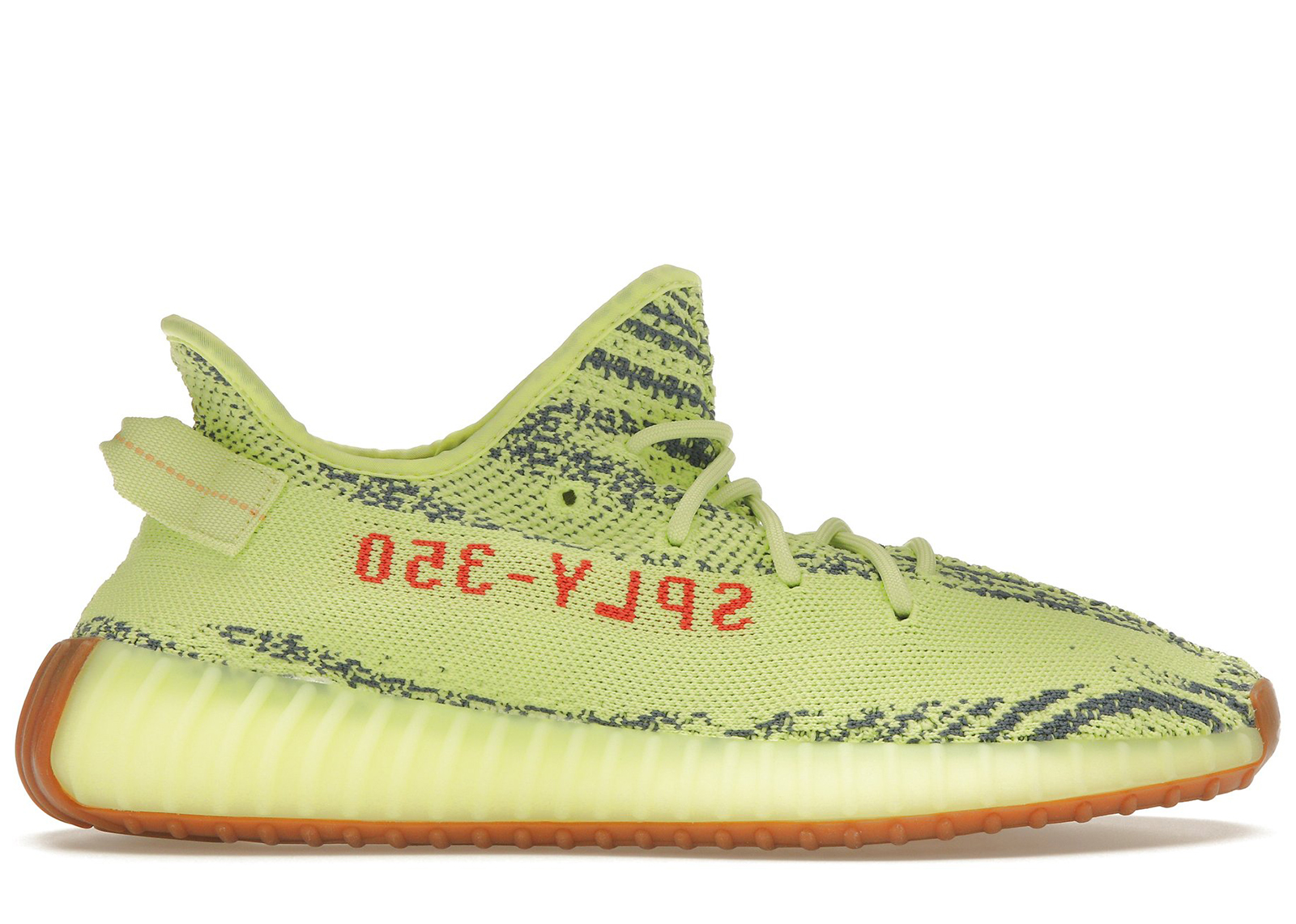

Eventually, prices for restocked Yeezys do start climbing again. Deadstock supplies typically diminish over time and this puts a gradual upward pressure on prices. The only event that can hinder this gradual climb to resale salvation is a secondary restock. Yeezy Supply has a reputation of being a secondary restock hotspot with its most popular models, the Yeezy 350 V2 Zebra and 700 Waverunner, each seeing three separate restocks. The 350 V2 Zebra is even rumored to restock again in Asia this summer.

Just like primary restocks, secondary restocks have a big impact on prices, though on average, they are somewhat less extreme:

Across all the models in our sample, secondary restocks (which include both 2nd and 3rd restocks of the same colorway) result in a median price decline of 17%. Thus, the decline that results from a secondary restock is, on average, 12% less critical than primary restocks.

Across all the models in our sample, secondary restocks (which include both 2nd and 3rd restocks of the same colorway) result in a median price decline of 17%. Thus, the decline that results from a secondary restock is, on average, 12% less critical than primary restocks.

The Yeezy 700 Waverunner is an example of how impactful primary restocks are compared to trailing secondary restocks. When the Waverunner first restocked, its resale value plummeted from $835 to $512, a critical 39% drop in four weeks. Less than six months later, the Waverunner restocked again on Yeezy Supply. Prices dropped again – this time by only 18%, less than half of the original price decline. The data shows that, while they’re still costly, secondary restocks don’t have nearly the same impact as primary restocks on resale prices.

Yeezy Models Most Affected By Restocks

The Yeezy 350 V2 is the most mass-produced silhouette in Yeezy history. Since 2016, over 50 colorways of the 350 V2 have been released on Yeezy Supply with numerous restocks being attributed to the most popular releases. With supply seemingly limitless, the 350 V2 has been shown to be the majorly affected by restocks when compared to other models.

Across both primary and secondary restocks, the median Yeezy 350 V2 suffered a brutal price decline of 26%. Whereas the median Yeezy 700 restock was less affected, declining by only 17%. Differences in restock effects tie in directly to the amount of Yeezys supplied into the market. There have been twice as many major Yeezy 350 V2 restocks as there have been Yeezy 700 restocks. The 350 silhouettes may still be the most popular, but it’s possible that buyers view the 700 as more limited, and thus, they are less sensitive to potential increases in supply.

Understanding restocks, and how they affect Yeezy supply and demand, is key to understanding the entire Yeezy resale market. Even Yeezys that don’t restock are influenced, indirectly, by the restock effect. Average Yeezy resale prices have fallen by nearly 70% since 2016. It used to be common for new Yeezys to resell for $1,000 or more. Now, it’s rare that a new release cracks $400 on the secondary market. In part, this is a function of increased supply for new Yeezys; they just aren’t as limited as they used to be. But it is also about the anticipation of future supply due to potential restocks. If buyers think they’ll have a second (or third, or fourth) chance to cop on Yeezy Supply down the road, there’s a limit to how much they’ll pay now.

In this way, restocks are a constant source of downward pressure on prices. Love them or hate them, they’re a permanent feature of the Yeezy resale market. For buyers, this new Yeezy market provides accessibility like never before to models that were formerly considered grails. But for sellers, increases in the overall Yeezy supply has forced them to either shift their business model to sell high quantities with lower margins, or move to a new market completely.

The violence associated with sneakers, which dominated the 1990s narrative of sneaker culture, was always a function of their scarcity: these were products so limited, people would do anything to get their hands on them. While the exclusive brand image of Yeezy has been put in jeopardy from increased Yeezy supply, the sneaker world is certainly safer because of it.