Best Selling Sneakers

The graphic above shows the top 5 highest GMV (Gross Merchandise Value) sneakers of July and their respective market share (calculated as a share of the top 10, not all sneakers sold on StockX during the month).

The graphic above shows the top 5 highest GMV (Gross Merchandise Value) sneakers of July and their respective market share (calculated as a share of the top 10, not all sneakers sold on StockX during the month).

The Jordan hype shows no signs of slowing down anytime soon with Jumpman securing four of the top five best selling sneakers in Europe last month. The freshly released Air Jordan 1 Satin Snake Chicago replaces the Air Jordan 1 High Light Smoke Grey in the number 1 slot, with the High and Mid versions of this colourway dropping to fourth and fifth on our list, respectively.

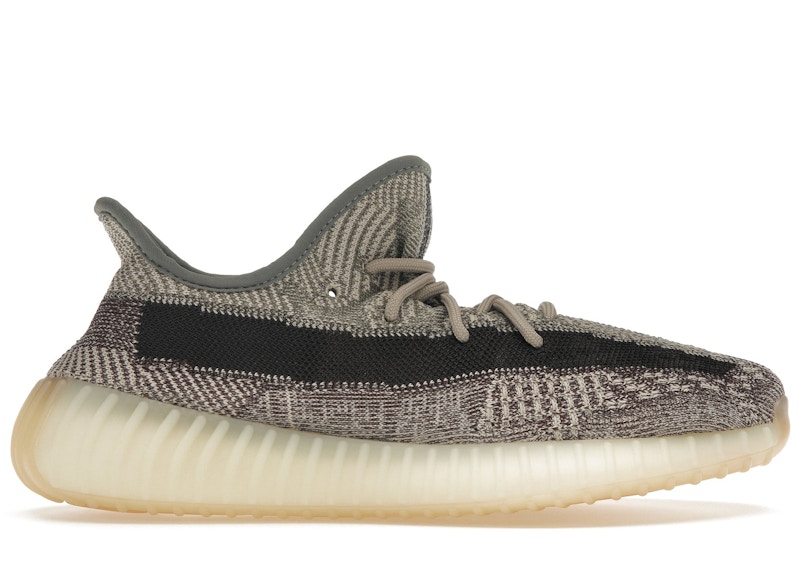

Meanwhile, the Air Jordan 4 Off-White Sail and Yeezy Boost 350 v2 Zyon maintain their top-five status, with the Yeezy just edging out the Jordan to claim second spot. However, it is worth remembering that the Off-White is selling for nearly 4 x the price of its Yeezy rival on average, illustrating the continuing desirability of Off-White and Nike collabs, despite their high resale premium.

Trending Silhouettes

The graphic above shows the % increase in GMV of respective silhouettes in August compared with GMV from the previous month.

The graphic above shows the % increase in GMV of respective silhouettes in August compared with GMV from the previous month.

Despite the Air Jordan 1 dominating the sales charts, there are early signs that the European audience is starting to branch out to alternative Jordan silhouettes, with Air Jordan 3s in August enjoying a 65% increase in sales compared to July.

The gap between sales of Jordan 1 Highs and Mids has also narrowed, with the Air Jordan 1 Retro High Black Gym Red Black (+68%), Air Jordan 1 Retro High Bloodline (+17%), and Air Jordan 1 Retro High Fearless UNC Chicago (+17%) all experiencing increased sales in August.

We spoke last month about the impact the Air Force 1 was having on Nike sales data, and this trend continued with the Nike Air Force 1 Low White ‘07 enjoying a massive 189% increase in GMV. The Air Force 1 Low White ‘07 was actually the seventh most purchased sneaker in Europe overall, ranking #1 in Switzerland, #4 in Italy, #9 in Germany and France.

However, Nike’s real MVP for August was another iconic silhouette, the Air Max 1. Driven by a string of new releases, including the Anniversary and SNKRS Day editions, Air Max 1s increased their sales value by 59% last month.

Country Breakdown

The graphic above shows the sneaker that generated the highest GMV in each country in August.

When we start to break down the performance on a local level, it’s clear that one size does not fit all for European sneakerheads. Germany and Switzerland continued to ride the MJ wave with the Air Jordan 1 Mid Light Smoke Grey and Retro High Court Purple topping the sales charts.

In Italy, eight out of the top ten product were Jordan 1s; across the ten most popular sneakers in August, the Jordan 1 silhouette accounted for 84% of total sales.

As with last month, the Air Max 1 reigns supreme in the Netherlands, with Tinker Hatfield’s iconic design taking over six of the top ten spots, primarily driven by the Air Max 1 SNKRS Day Brown release.

Over in France, the Air Max 1 Anniversary Green continued this trend with a strong performance but was ultimately beaten to top spot by the Yeezy Boost 350 v2 Zyon. Despite this, the Anniversary Green was the most popular Air Max 1 colourway to be purchased in Europe last month.

Most Expensive & Price Premiums

The graphic above shows the most expensive purchases by European users in August

When it comes to overall resale price, one sneaker stood high above the rest this August: the Air Jordan 1 Retro High Colette (F&F). One European buyer paid an eye-watering £9,650 for the Parisian boutique’s final release.

Among European buyers, the sneaker with the biggest price premium in August was the Nike SB Dunk Low Grateful Dead Bears Orange. European buyers paid an average price premium of over 3000% above retail for the Orange SB Dunk “Bears”.