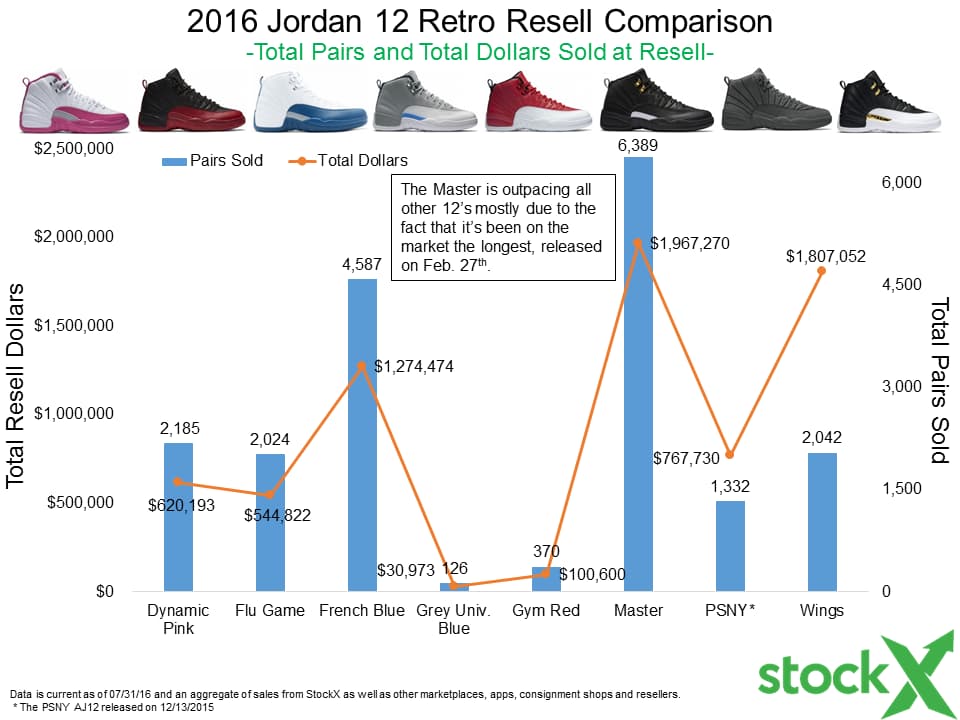

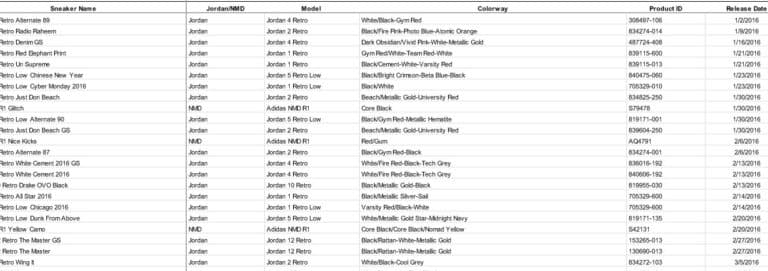

So far this year we’ve seen seven different colorways of the Jordan 12 drop, eleven if you include the GS only releases. Twelve if you include the PSNY pair that dropped in mid-December 2015. (From a resell perspective, almost all of the activity on the PSNY has happened in 2016 so we included it in this analysis) According to industry news, there are at least five more Jordan 12’s releasing between now and December 31, 2016 and we would take odds on that number increasing before the ball drops.

The most eagerly anticipated Twelve is without a doubt the white OVO collab that, as of publishing this blog, we have yet to see anyone confirm a release date for. Anyone rock a size 13 and want to be on team early? Act now because there are currently two Asks live for a size 13 on StockX. While the rest of us wait for The Six God to bless us, the data nerds at StockX felt that this was a great time to take a moment and review the resell numbers on the Jordan 12s that have released thus far in 2016.

All of the data included in this analysis is current as of 7/31/2016. Just like the StockX price guide and sales history, all results are an aggregate of sales on StockX as well as other marketplaces, apps, consignment shops and resellers. With that disclaimer out of the way, let’s dig in to the numbers.

The Masters come out on top in both total dollars and pairs sold. This should make sense to most as they were a general release and therefore have been on the market the longest, releasing on February 27th. What’s interesting to point out though, is that the Wings has generated almost as many resell dollars as the Master but has only sold around a third as many pairs.

At first, we were going to limit this analysis to men’s sizes only, but when we looked at all of the numbers more closely, we were surprised (actually, we weren’t) to see that the Dynamic Pink pair that was released in early March, is beating out the Flu Games in total pairs and total dollars. We expect that over time, the Flu Games will eventually overtake this pair popular among small footers and their significant others who have #relationshipgoals. Remember, real men wear pink.

Going a little deeper, we take a look at the resell profits for each colorway of the Jordan 12. The assumption here is that profit margin is being defined as (Average Resell Price) – (Average Retail Price). Hopefully you copped at retail.

With the exception of the Masters and the Dynamic Pink, general release pairs haven’t been too kind to resellers. When you factor in selling and shipping fees, as everyone should, you’re about at break even. On the other end of things, the PSNY and Wings, as we have seen time and again for premium releases, have been amazing investments for resellers. Again, this is assuming you were able to get them at retail…or at all. In fact, on average, you could sell a pair of Wings right now and turn around and buy a pair of Flu Games AND a pair of French Blues with your profits and still have enough cash left over for a nice steak dinner. Personally, I’d rather wear the Wings and have a turkey sandwich, but that’s just one guy’s opinion.

Before we move on, we wanted to come back to the Dynamic Pink for a minute. It’s worth pointing out that their profit margin is better than EVERY general release so far this year. We assume all of the hype around this pair was/is because of dudes like this:

OK, let’s move on.

One of the most telling indicators of how a retro release is performing is by comparing it to its previously released version. In the case of the 2016 releases of the Flu Game and the French Blue, all of the data points to their prior releases being better investments for resellers. The profit margin on the 2009 Flu Game is $54 greater than the 2016 release. The difference between profit margins on the 2004 and 2016 French Blue is even greater, at $70.

Part of the reason for the lower profit margins on the 2016 releases might be because of differences, perceived or otherwise, in materials or color or quality from one release to the next. It could be that the restocks on the 2016’s has driven down their resell prices. Or, it might have something to do with how the increases in retail prices ($150 to $190 for the Flu Game; $135 to $190 for the French Blue) have outpaced inflation rates over the same time periods. Or, it could be explained by some super complicated algorithm that takes into account the consumer consumption of beer index, the point differential of every NBA playoff game between 2004 and 2016, the outcome of the midterm elections and the current state of the Kanye vs. Taylor feud. Who knows for sure though. We just report the data, we don’t make it.

Whatever your opinion of the Air Jordan 12 might be as you read this, we still have a ways to go before we can measure the full impact of this run of retros. Let us know if you’re seeing something interesting the data that we missed. Until next time, for all the buyers out there make sure you’re Bidding right and Bidding often. For the sellers, Ask right and Ask often.