Watches and sneakers are really not that different from each other, at least they shouldn’t be to the collector’s eye. Both collectibles can be extremely expensive and even harder to obtain, which drives their success on our site.

So why do sneaker flippers see themselves differently from the typical watch consumer? With opulent watch marketing catered towards customers other than streetwear-headed sneakerheads, it’s hard for them to connect to a grown-man’s game. If they looked past the upper-class advertising, they would see that they have the right sneaker hustling mentality to successfully make a profit in the watch world.

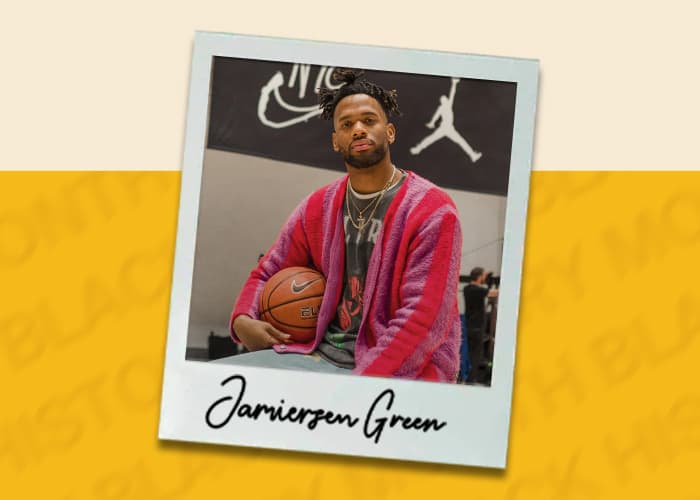

As a sneakerhead for over seven years, I’ve experienced the hunt of buying and selling high profile shoes. I never really saw myself interested in selling anything else from what I already know. But, as I’ve worked at StockX and getting more familiar with watches, I constantly wonder, “Why haven’t I done this sooner?” As sneakerheads, we justify buying sneakers for $200, $700, and even $2,000. With some watches retailing for only $500 and reselling for thousands it should be a no-brainer to validate such a purchase. Flipping watches can be just as easy, or even easier, as flipping sneakers and here’s why:

Watches Retain Resell Value After Being Worn

The biggest difference between watches and sneakers in the secondary market is their acceptable condition. When it comes to sneakers, they tend to hold their value when unworn, getting the most profit without even trying them on. Let’s look at the Air Jordan 4 White Cement from 2016. A brand new, size 11.5 pair on StockX sells for $375, but when worn once or twice, the shoe instantly drops in value between $270-$300, as seen on used secondary markets, around 39%. Now, that might not seem like a big price difference, but it is telling of the profit lost for only wearing the shoes a couple times.

When it comes to reselling watches, they’re a whole different story. The demand for pre-owned watches is high, especially from certain brands such as Rolex and Omega, the poster children for the watch community. If we look at the Rolex Submariner 116610LV “Hulk”, a watch that released in 2010 for $9,950, it has sold for $11,800 in this year alone, rising about 18% in value. That’s a $2,750 profit all while pre-owned and without original packaging.

Selling a pair of shoes without it’s OG assets like the box and laces, only drives the value of the shoe further down in the red, but it is a normal occurrence in watches and doesn’t affect the resale value of many pieces.

There’s Never a High Volume of Watches Produced

Nothing is more detrimental to the resale value of a sneaker more than a restock. If you bought those Yeezy 350v2 Zebras for resale back in 2017, you might of just played yourself, as they will be restocking for a 3rd time this year, driving their resale price even lower.

Watches, on the other hand, rarely succumb to restocks and are made in extremely limited quantities. Every year, Rolex makes about 800,000 watches a year, releasing within their catalog of 14 models. When looking at the recent release of the Air Jordan 11 Bred, over 2.1 million pairs were produced of that one sneaker alone, out of Jordan Brand’s 34 silhouettes!

With numbers like that it goes to show that in terms of value retention watches take the cake. Just look at last year’s Casio collaboration with BAPE. The watches were sold in limited quantities around the world and were only available at BAPE brick and mortars. Retail for a piece was $284, but initial resale price in 2018 shot up to $620 for a pre-owned watch. They have even been sold for as high as $1,295 earlier this year, more telling of watches’ continued high value.

Watches Don’t Follow Trends

Fashion is cyclical. Some things come back in style while others don’t ever see the light of day again. Sneakers fall under this spell, with the rise of dad-shoe culture as a prime example, making once undesirable shoes become some of the hottest accessories to an outfit (shout out to New Balance). This leaves the market very vulnerable and often dependent on trends. But watches are a valued product not falling victim to the swinging pendulum of fashion.

There are watches that hold a great track record of not easily moving with the times, holding their resale value. The Omega Speedmaster has been around since the late 50s, being the first watch to accompany Neil Armstrong to the moon. There have been many reiterations of the watch, all staying true to its original form. Two years ago, Omega brought in the Speedy Tuesday, adding to the line of Speedmaster watches. Since its 2017 release, the watch has not diminished in resale value, selling for $10,000 in pre-owned condition that same year, way above its $6,500 retail price tag. And since its release, the watch has still maintained a high resale price, selling for 24.6% over its original MSRP. It just goes to show that while there is an unpredictability within the sneaker market, watches maintain some level of consistency. Watches do not succumb to hype like sneakers, helping them maintain their value.

Let me make this clear, I am not telling people to stop buying and selling sneakers. Sneakers are an amazing investment and have helped spark entrepreneurial spirit. I wouldn’t be where I am today if it weren’t for sneaker reselling. But if you want to make even more money, picking up watches is a great next step. And just like sneakers, not all watches are complete blue chip products and it takes time to transition into the hobby, but once you make your first sale it’s hard to leave this side hustle alone.