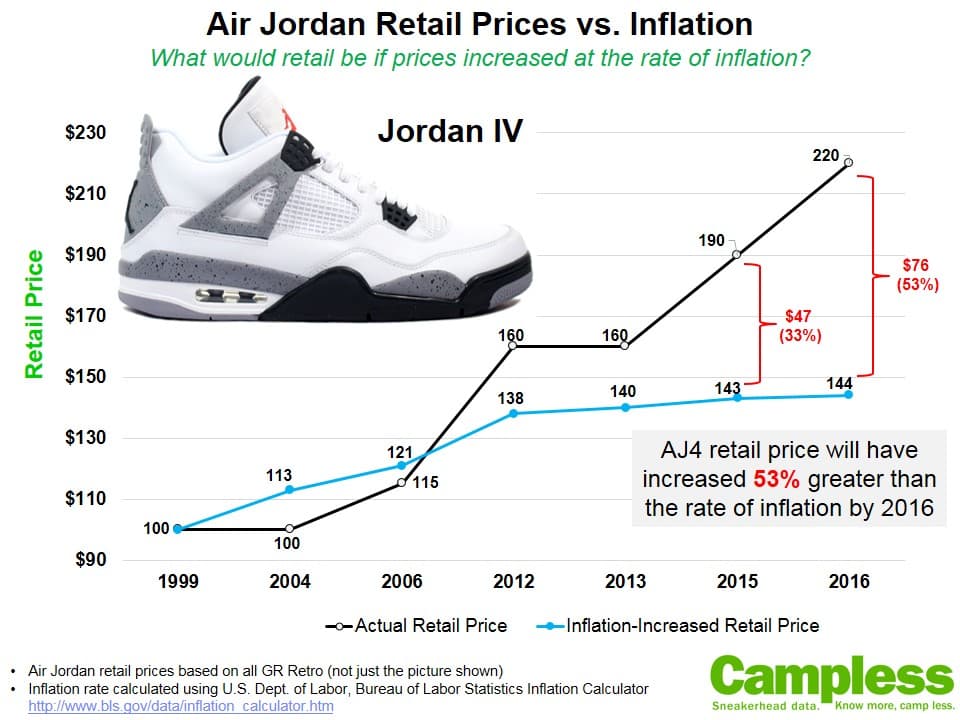

They used to be together, but now one is much greater than the other.

In March of 2014, on the heels of Jordan Retro GR prices jumping from $160 to $170, we undertook the analysis “Are Jordan Retail Prices Outpacing Inflation?” The answer, at the time, was no. Although retail prices were definitely increasing, Nike was not raising prices at a rate greater than inflation. The analysis showed that, in 2014 dollars, most retail prices since 1999 were within $10 of 2014 actual prices.

Since then, Jordan Brand increased retail prices from $170 to $190 for 2015, and just recently announced that 2016 retail for the Jordan 4 and Jordan 6 would be $220. In light of what feels like a pretty big jump, regardless of any “remastering”, we felt this analysis needed to be revisited.

Methodology

- In the interest of more information, we’re including five models. Last year we used the AJ3, AJ5 and AJ6. We’re adding the AJ4 and AJ11.

- In the interest of simplification, we’re taking a different approach. Last year we used 2014 purchasing power as the relevant measuring stick. This time we’re asking a simple question: What would retail be if Nike had increased prices at the rate of inflation? For each shoe, starting with its first Retro, we track the actual retail price side by side with what the retail price would have been if Nike had raised prices at the rate of inflation through the years.

Results

Key Insights:

- In 2001, retail was $100. If you follow the blue line you will see that, had retail increased at exactly the rate of inflation, prices would have been $104 in 2003, $117 in 2007 and so on.

- Following that line, retail prices would have been only $134 in 2014, when actual retail price was $170. That’s a 27% gap.

- No Jordan 3s have released in 2015 (due to its temporary “retirement”) so we’re using 2014 retail prices. If the Jordan 3 had also jumped to $190 (like other GR Jordans this year), the inflation gap would have risen to 40% ($54).

Key Insights:

- The 2016 Jordan 4 price hike to $220 prompted this whole analysis and, notwithstanding the fact that might be a premium price due to “Nike Air” on the back, it’s still a pretty big deal. As such, we’ve called out both the 2015 GR price gap (33%) and the expected 2016 gap (53%).

- In any data work it’s important to understand limitations created by the parameters of the analysis. In this case we should note that even though the AJ3 and AJ4 both started out at $100 retail, because the Jordan 3 price was in 2001 and the Jordan 4 price was in 1999, by the time we get to 2014-2016, the inflation adjusted price of the Fours is ten bucks more than the Threes.

- But because the AJ3 hasn’t released since 2014, the Jordan 4 inflation gap is much greater.

- Bottom line: The Jordan 4 is WAY more expensive than it should be…

Key Insights:

- The Jordan 5 started out at $120 in 2000, so it’s inflation-adjusted price would have been $166 this year – only 14% less than actual retail.

- For a couple years the price of the Five was actually less than inflation, including as recently as 2011.

Key Insights:

- The Jordan 6, even moreso than the Jordan 5, was lock-step with inflation for many years – basically all the way until 2014.

- But with the impending Jordan 6 Maroon carrying a $220 price tag for 2016, that 3% difference is about to blown up to 31%

Key Insights:

- The Jordan 11 is a perfect shoe for this analysis because it’s been released every year since 2009.

- If you follow the trend you can see that retail price has remained just a little bit greater than inflation for five years (2009-2013), then took a small jump in 2014, and a bigger jump in 2015.

- The Jordan 11 retail price is now 27% greater than the inflation price

Key Insights:

- Through 2015 the Jordan 4 retail price has increased the most, at 33%. The Jordan 6 is only 3% greater than inflation.

- If we look ahead to 2016, the Jordan 4 will continue to lead the pack at 53%. The Jordan 6 will be taking a big jump from 3% to 31%.

Conclusion:

Air Jordans are getting more expensive – actually and relatively.

But does this even matter?

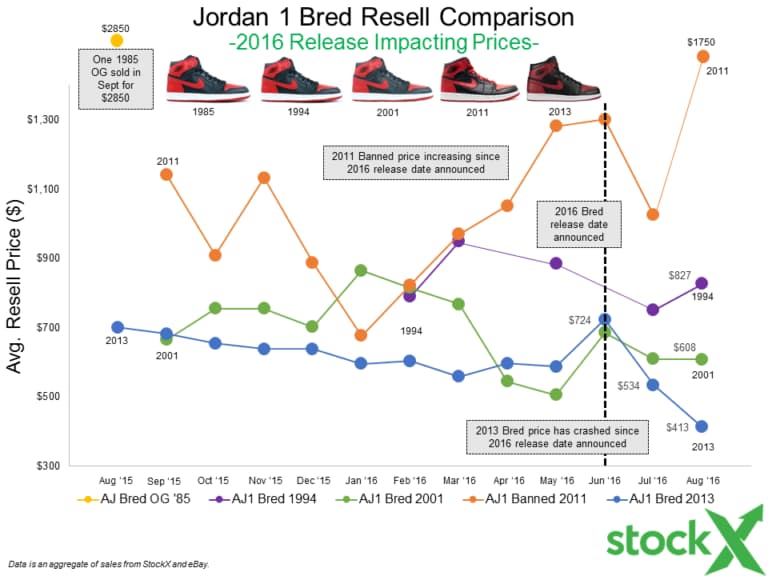

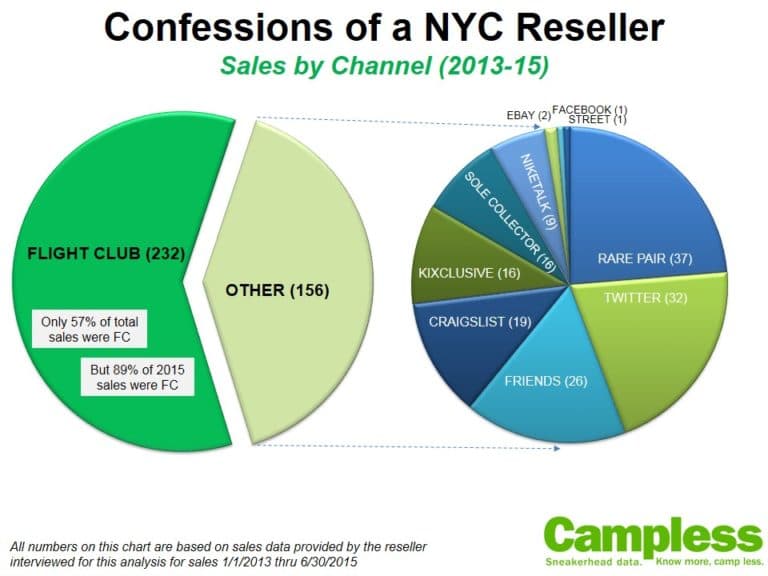

The elephant in the room is resell value. Of course.

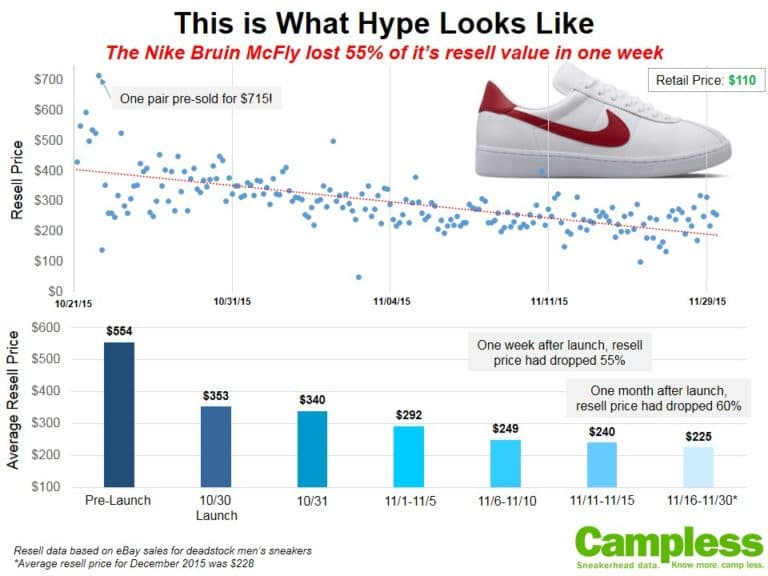

On one hand, it doesn’t actually matter what the retail price is. As long as resell is greater than retail, there will be sellouts, there will be resellers and the sneakerhead equilibrium will remain in tact.

On the other, this is clearly Nike taking a small piece of resell profits, as we thoroughly discussed in “An inquiry into . . . can Nike get that resell cash?”

As an example, let’s look at just one release: The Jordan 11 Legend Blue did $81 million at retail it’s first three hours. The $200 retail price was 16% more than the theoretical $172 inflation-adjusted price. That translates to $11.3 million that Nike effectively took out of the pocket of resellers and put into their own bank. Granted, the annual AJ11 does more volume than any other release for the year, but there are 50 Jordan releases every year . . . let’s say they average 100k sold (about 1/5 of the Legend Blue) . . . that’s still over $100 million easy.

Maybe it’s not such a “small piece” after all…

Well played, Swoosh.

—–

And on that note:

https://var/app/current/news-tmp-0801.youtube.com/watch?v=Eo-KmOd3i7s

————–

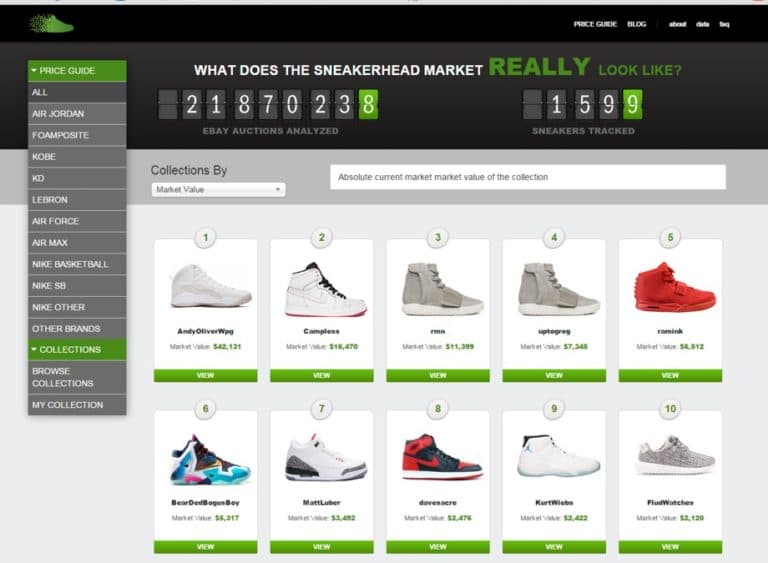

Big thanks to Kurt Wibell (@KurtWiebs) for a carrying the weight of the data work on this one.

————–