Every time there’s a big restock someone claims Nike does it to discourage resellers. The theory is that a restock puts enough additional supply into the market to drive down the resell value of the shoes restocked.

Testing this theory is not easy. We’d need to isolate the resell price of sneakers before and after a restock (easy), and compare the pattern of price movement over time to the normal price movement over time of similar, but unrestocked pairs (not easy). Determining the “normal” price movement over time is not as simple as it sounds (or, perahps, it’s even more complicated than it sounds). Another key inhibitor is identifying restocks which truly put enough quantity back into the market to have an impact, particularly because Nike doesn’t publicize restock volumes.

In light of the many difficulties in performing the complete analysis, we’ve decided to do a related test and examine the largest single-sneaker restock of the past two years: the Air Jordan 11 Bred re-release. The Bred 11 originally released December 21, 2012. Three months later, March 24, 2013, Jordan Brand had a full scale re-release. If we can’t see some evidence of resell prices dropping here – with a second release, putting perhaps tens of thousands of additional pairs into the market – then its doubtful we would see much impact from a small restock where ten or twenty shoes are restocked at the same time.

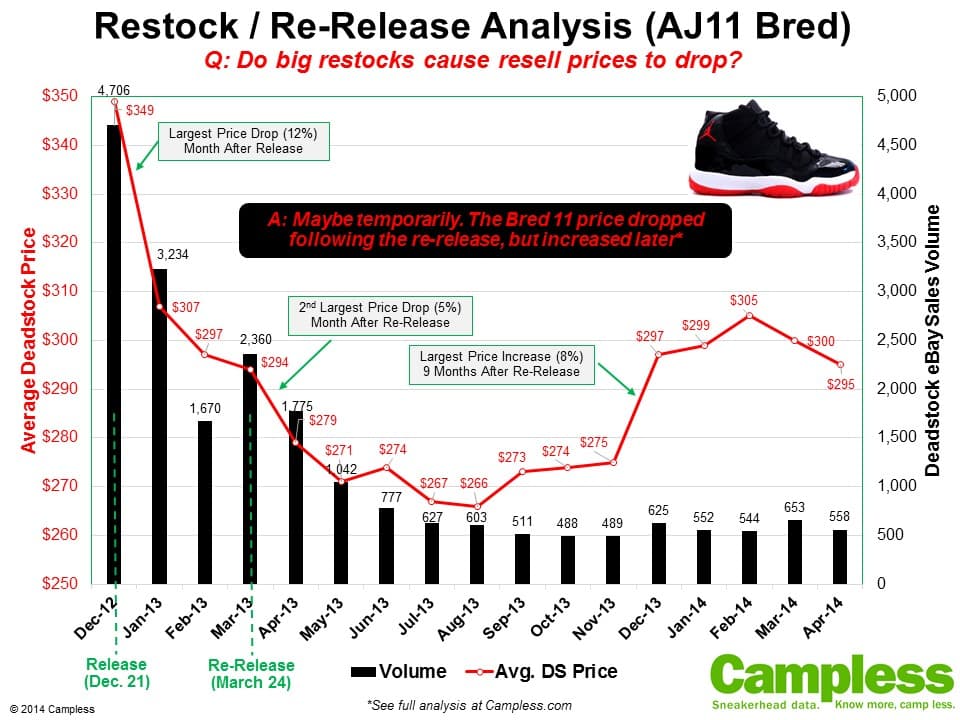

The following is a view of Jordan 11 Bred eBay sales – price and volume for deadstock pairs – from its original release in December 2012 through April 2014:

Key Insights – VOLUME

- The typical resale volume pattern over time is a downward curve, starting with its peak immediately following release, and continuing downwards towards zero, the farther away from release date it gets. As pairs find their way into the hands of those who want to own them, and pairs are worn and resurface on the resell market as “used”, the number of DS pairs available declines quickly.

- The Bred 11 re-release, which is noted above in March 2013, shows a significant increase in total sales – in expected opposition to the typical volume curve. After dropping 31% from December to January, and another 48% from January to February, sales then went up 41% from Feberuary to March.

- In short, the Bred 11 re-release put significant additional supply into the market.

Key Insights – PRICE

- In the 19 months since the Bred 11 first dropped, there are only two months during which the average deadstock resell price dropped by more than 3.5%. The largest drop was a 12% decrease in the month following release (Dec 2012 to Jan 2013). This makes sense and comports with other data we’ve seen which shows that pre-sale and initial release pricing is often artificially inflated due to the hype, and prices quickly drop as the sneaker blogs move on to cover the following week’s drops. In short, it make sense that there would be a large drop from the frist to the second month.

- The second largest drop, however, was 5% and occured during the month following the re-release (March to April 2013). This fits with our theory that additional supply in the market will cause the resell price to drop. Although the price had been decreasing every month since launch, this was clearly an accelerated decrease. You can see the steep curve on the chart above.

- In short, Bred 11 resell prices dropped following the re-release.

So we have evidence: If you put enough additional pairs into the market, the resell price will drop. But this is hardly conclusive that restocks, in general, cause resell price to decline. Many other questions weigh on the analysis:

Unanwered Questions:

- Is the Bred 11 price movment different from the “normal” price movement of similar, but unrestocked pairs? We need a lot more data to answer this.

- How many pairs are necessary to move the price down? The Bred 11 was a full re-release, not a TLO restock.

- How much must the price drop, and for how long? We can clearly see that, five months after the the re-release, the price of the Bred 11 started increasing again. Within four more months it had surpassed its pre-re-release price ($297 vs. $294) and appears likely to keep increasing.

Conclusion:

For now, all we can say is this: If some significant number of pairs are restocked into the marketplace, the resell price may drop temporarily, but will eventually return to and exceed the pre-restocked price.

We will continue to collect data in the hopes of creating a broader analysis on the subject.

What do you think? If you’re a reseller, do restocks affect your business? If you’re a buyer, do you find better deals after a restock?

—–

Don’t forget to take the Sneakerhead Survey and contribute to a better understanding of our community.

Want a pair of Bred 11s? Buy ’em here.