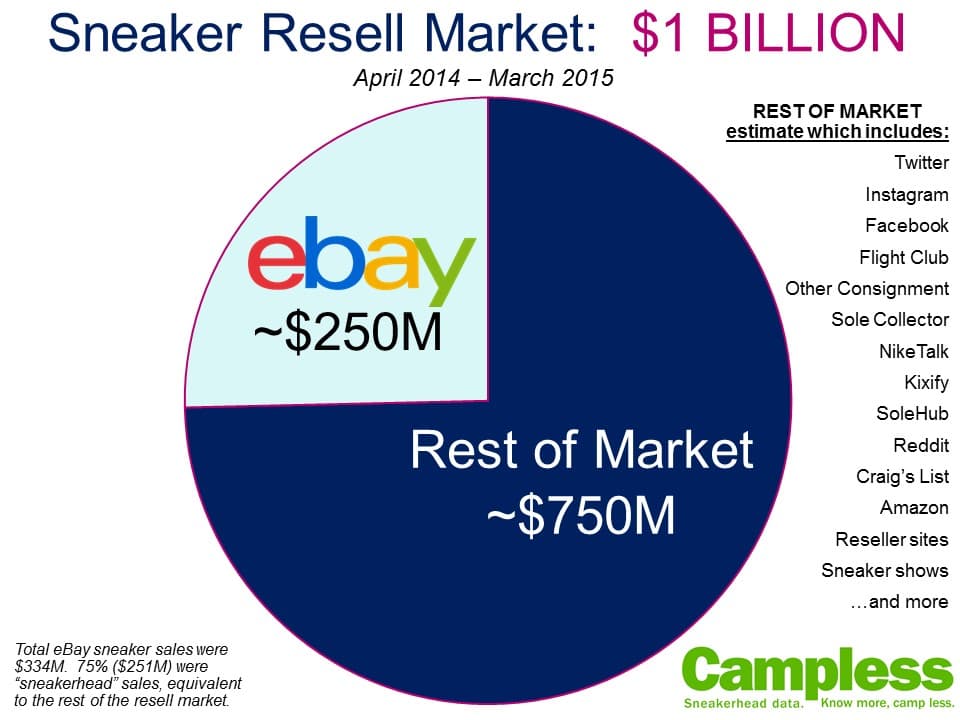

In October of 2014 we sized the resell market at $1 billion. Last week Financial Times ran a resell sneakers story and included our $1B estimate. Within the next two days at least five sneaker blogs reported that the Financial Times had pegged the market at $1B. I guess it’s time we publish an update . . .

That said, the market is essentially identical to where it was in October . . . at least in total size: $1 billion. In October, eBay sneaker sales the 12 months prior had been $338 million. Currently, that number is $334 million. We still estimate eBay to be 75% “sneakerhead”, and we still estimate eBay to be one-quarter of the entire U.S. resell market.

Here is a breakdown of monthly eBay sales for the past 27 months. As noted often by this blog, the secondary market is cyclical. This chart makes that obvious, as you can see spikes from December to March each year, with dips in the spring and summer.

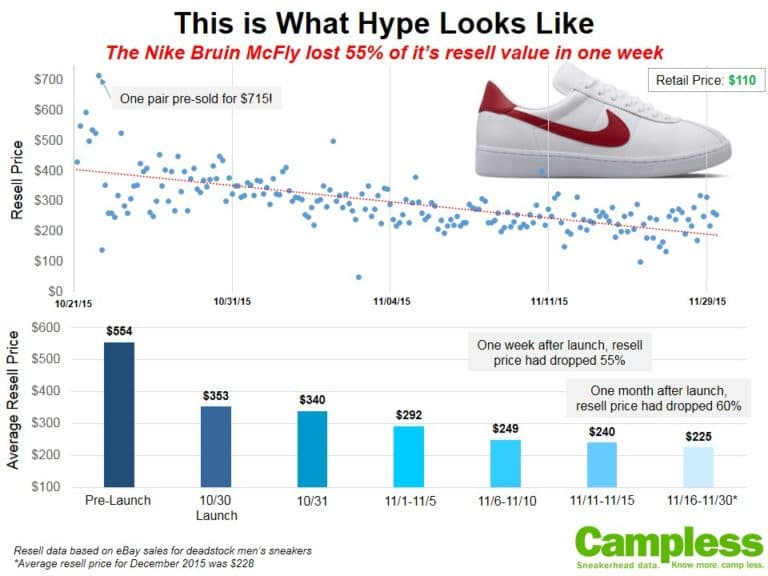

At first glance the monthly eBay chart above seems to add no great insight. In October we reported that the market was growing; here we can see the market has grown 12% versus the previous 12 months. So it might feel right to conclude that the market is still growing, as it was in October. But upon closer inspection, something seems off. These past few months – the 2015 green bars – should probably be taller. In a growing market we would expect the tallest bars to be the most recent months. But that’s not what we see, is it?

The above chart is total dollars. A better way to look at market growth is to compare growth rate. Because the sneaker industry is cyclical, it’s best to compare same-month year-over-year sales. For example, we would compare January 2014 sales to January 2013 sales. When we plot growth rate percentages, the chart looks much different:

January 2015 marked the first time in the three years since Campless began tracking the resell market that eBay sneakers sales declined. Although there were still $26 million in resell, January 2015 was 5% less than January 2014. February and March continued the decline, recording -10% and -14% versus same-month previous-year sales. The trend line (dotted black line) sloping sharply downward is as clear as day. This market is definitely not growing anymore and, for the past three months, has been declining. To quote the great Joey Lawrence: Whoa!

And this feels right. Who among us hasn’t noticed the overwhelming crush of release saturation? Since Thanksgiving the number of pairs released per week has been comical, with severe overloads around Black Friday, Christmas, New Years and All Star Weekend. Hell, All Star Weekend became All Star 10-Days of Drops – and the majority of those were GRs; true gems (Fragments, Don C, Mirror Foams) were few and far between. Top resell shops like Sole Supremacy and 23Penny put out warnings that they wouldn’t buy All Star releases, and this piece from Sn’eads by Ree and accompanying picture from a Nike Outlet sums it up:

Picture from Complex, using art from Sn’eads by Ree

It would, reason, then, that the market as a whole may be declining. Using our eBay data as a proxy, a 10% dip might be right. But…

…before you freak out and Rick James someone’s couch, let’s be very clear about what “market” we’re analyzing, and how. Release saturation and the All-Star recap is anecdotal. The only hard data we have is eBay data – not the secondary sneaker market as a whole. Yes, eBay is the largest resell channel. And, yes, eBay is the perfect mid-market position reflective of true pricing. But that doesn’t mean it can’t trend differently than other channels, or the market as a whole.

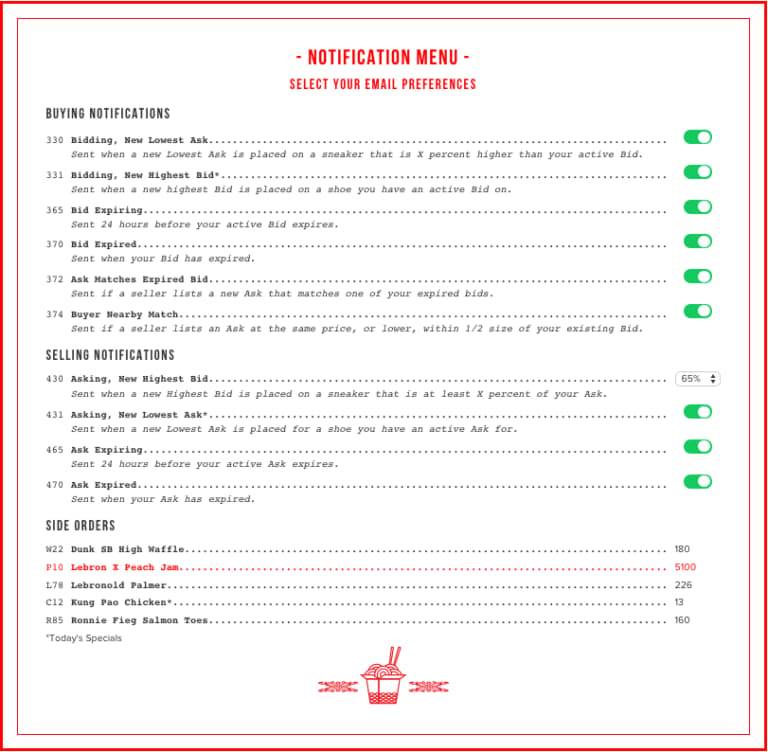

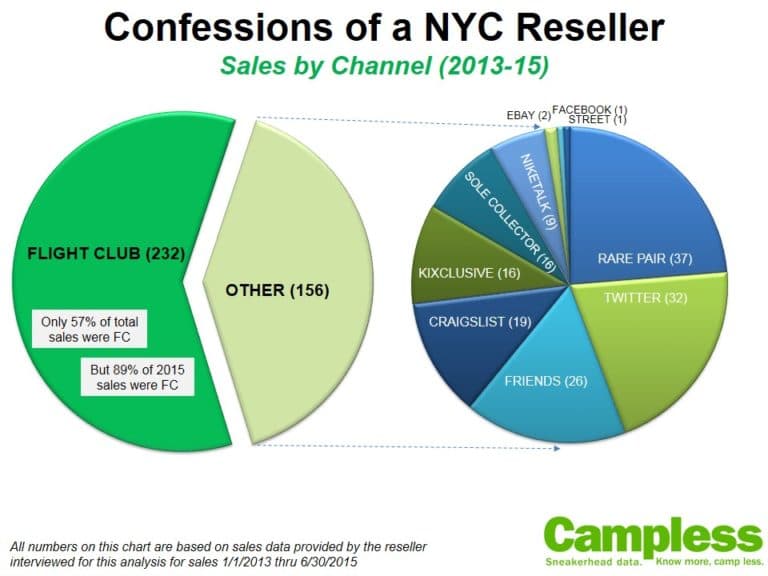

Here’s a different view. Maybe sales are moving away from eBay and to other channels? Facebook, Twitter, Instagram, Reddit, Amazon, Craig’s List, sneaker shows, resell shops, consignment, Kixify, Sole Collector, Nike Talk, new apps, new marketplaces, new ideas…the list is literally endless, and growing by the second.

Another possibility…even if they’re NOT switching channels, maybe we’ve reached a tipping point of sneakerheads learning how to source deals on eBay but close them on Paypal? While overall sneaker sales are declining, the number of pairs being listed on eBay is still increasing, albeit at a declining rate:

Even though the rate of growth for sneaker listings in declining, it’s still growing. To put it in context, in 2013 the average number of listings per month was 455K. In 2014 that number was 677K. That’s a lot of sneaker listings. And if sales are declining, it stands to reason that at least some of these which start out listed on eBay end up being sold offline.

These are real possibilities, all of which imply the market is just fine, it’s eBay that’s declining.

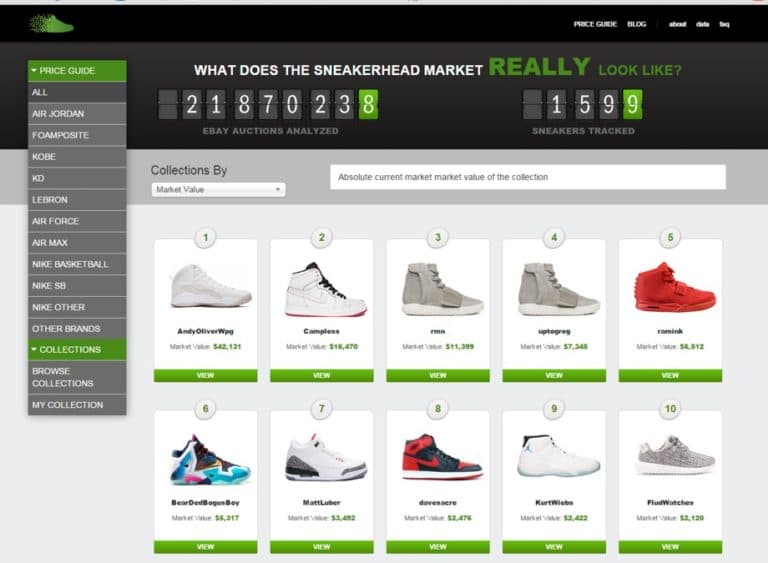

Unfortunately, we don’t systematically track other channels. We have spot data on every channel, but not enough to truly answer the question. This has inspired us to make some changes behind the scenes and we’re going to do our best to collect as much data as we can about as many other channels, so that the next time we have this conversation, we can shed a little more light on the issue.

In the meantime, we’d love to hear what you think:

A. The resell market as a whole is declining.

B. The resell market is fine. It’s just eBay declining.

Choose one.