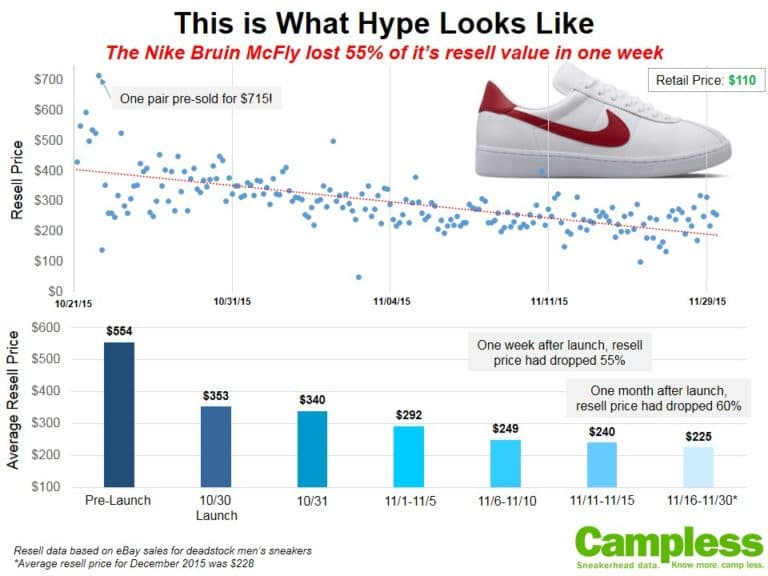

A few weeks ago, we performed our first analysis about the resell price of sneakers over time. Specifically, we analyzed the Jordan 11 Bred re-release in the hopes of learning something about the impact of restocks on price. In that post we highlighted several key issues releated to how resell price changes over time. This post is our next attempt at unpacking some of those issues, including:

1. What is the impact of presales?

2. How do multi-shoe restocks impact resell price?

3. What is the “normal” trend for resell price over time?

Data Set: We identified a group of sneakers with similar release dates, months of resell history, retail price, resell price, production numbers and restocks. The result are these seven sneakers, all of which were part of the May 2014 restock:

| Sneaker | Release Date | Retail Price | Avg. DS Price |

| AJ3 Fear | 8-24-13 | $175 | $274 |

| AJ3 Fire Red | 8-3-14 | $160 | $184 |

| AJ4 Fear | 8-24-13 | $175 | $277 |

| AJ4 Green Glow | 8-17-13 | $160 | $229 |

| AJ4 Toro | 7-13-13 | $160 | $230 |

| AJ5 Grape | 5-4-13 | $160 | $213 |

| AJ5 Black Grape | 6-15-13 | $160 | $272 |

Key Insights:

1. What is the impact of presales?

- Every sneaker’s presale prices were significantly inflated. On average, the average presale price was 16% higher than the price at release.

- Five of the seven never again reached the price it was during pre-release. Only the two Fear Pack shoes later had prices in excess of the presale price.

2. How do multi-shoe restocks impact resell price?

- Six of the seven sneakers had their resell price drop after the restock, although none significantly. The greatest drop was 8%, but most were less than 3%.

- Oddly, the price of the Air Jordan 3 Fear skyrocketted after the restock, rising a total of 36% in the two months following the restock.

3. What is the “normal” trend for resell price over time?

- Apparently, it’s a Nike Swoosh…

- The average curve over time is almost exactly as expected: inflated presale prices which come down hard and slowly increase over time.

- Even with the restocks we don’t see a decline in average price, although the growth rate slows slightly (as evidenced by the flattening of the curve in the last three months).

- All of this is to suggest that although a restock may have an impact on any one shoe, in the aggregate, it doesn’t significantly alter the resale lifecycle: In the end, resell prices move like the Swoosh.

The secret meaning of the Swoosh:

The real question, then, is whether Nike is so ingenious that it manipulates supply and demand so specifically (and so expertly) as to create a secondary market in the exact image of it’s logo?

Or, is the reverse true? Have we just uncovered the holy grail of sneaker myth-lore: the secret meaning of the Swoosh? Perhaps Carolyn Davidson wasn’t a graphic designer at all, but was, instead, a data scientist, years ahead of the game.

The story goes that she designed the logo in 1971 for $35 and then left the company – but maybe that’s what they want us to believe? Maybe Phil and Mark have had her locked in a data dungeon for the past 43 years, slowing working on the hardest analysis of her career? If Campless is suddently “bought out” by Nike later this week, you’ll know we were right.

Next steps:

Notwithstanding conspiracy theories which seem so amazing they must be true, we recognize the limitations of the above analysis, particularly because it’s based on a small, homogenous sample set – 7 general release Jordans. So, rather than the Swoosh being the “normal” curve for all sneakers, perhaps a better conclusion is that it’s the expected normal curve for GR Jordans (although we’d hope JB could make the curve look like a Jumpman). Granted, Jordans account for almost 1 out of every 3 sneaker dollars spent on eBay, so the Swoosh may actually be relevant for the entire market, but the point is that we have more work to do.

As we continue our work on resell price over time, perhaps our next analysis will use a larger sample of sneakers, including various brands, pricing and volumes.

What do you think? Is there a particular sneaker segment you expect will have a different trend over time? Or will all adhere to the “normal” Swoosh trend shown above?