In June of 2016, adidas announced a renewed and expanded relationship with Kanye West. In October of 2016 adidas (ETR:ADS) stock price hit a ten year high. Sneaker and finance media alike have been tracking adidas’ gains against Nike (still a long way to go), and for quite a while the sneakerhead community has been abuzz about adidas.

By all accounts, adidas is having a good run – including on the resell market.

It wasn’t always like that. For the longest time, adidas was a nominal part of the resell market. Then, in a series of up and down moves starting in 2014 – one positive, one negative, one positive, one negative, and so on – adidas became ‘sneakerhead significant’.

Overall, adidas has been on a positive trend towards embracing the sneakerhead community and have finally reached legit resell brand status.

Here’s how it happened.

This is the history* of adidas resell.

*(or at least important selected excerpts)

PRE-2014

At the end of 2013, adidas represented one-half of one percent of the resell market.

Prior to that, adidas didn’t have more than a few true resell pairs per year. In fact, we can fit just about every relevant resell sneaker for six years on one chart:

Here’s a quick rundown of the best of the best for 2008 through 2013:

- 2008 – adidas Consortium AZX Project: Around the same time as the Nike 1 World Project, adidas responded with this 25 pair Consortium project collaborating with boutiques from around the world, drawing inspiration from the ZX silhouette. Pictured: adidas x Wood Wood ZX9000.

- 2009 – adidas x Star Wars: Pairs of the Star Wars 2010 Collection were released as early as December 2009 (we had to really stretch for this one), and came correct with the Bape-esque toy packaging. Pictured: adidas Luke Skywalker (adaptation of adidas Top Ten).

- 2010 – adidas x Mastermind: Limited release + high-end Japanese streetwear brand = high resell. adidas has repeated this since then, most recently with the Mastermind NMDs. Pictured: adidas Mastermind Hardland.

- 2011 – adidas x RUN DMC: In celebration of the 25th Anniversary of their single “My adidas”, this shoe released on 11-11-11 at adidas Original stores. It retailed for $198.60 to match the anniversary year. 1986 pairs worldwide. Pictured: adidas x Run DMC Superstar 80s.

- 2012 – adidas x Big Sean: Big Sean’s first collab shoe with adidas, limited to 380 pairs worldwide. Pictured: adidas x Big Sean Pro Model II “Detroit Player”.

- 2013 – adidas x Bape x Undefeated: Part of a three-pair pack including two colorways of the Campus 80s, the ZX8000 was the star of the pack and you can’t go wrong with anything Bape because, well . . . hypebeast sh*t. Pictured: adidas x Bape x Undefeated ZX8000.

Some cool stuff, for sure, but that’s SIX years of resell relevance in under 250 words.

That being said, honorable mention from this era goes out to Jeremy Scott.

While high retail prices limited its resell potential, JS’s unique shoes are an important part of adidas’ history. From fuzzy animals to putting actual angel wings on shoes, each release made you say “WTF.” And, occasionally, there were one too many Fs associated with his shoes, such as the Roundhouse “Handcuffs” from 2012 that were cancelled before they ever released. Maybe if those handcuffs were fuzzy people would have thought differently, but what’s definite is that Jeremy Scott used adidas as a medium to bridge the gap between avant-garde fashion and streetwear culture. Foreshadowing a reoccurring theme here, Jeremy Scott’s drops are a microcosm of the up and down strides adidas made towards sneakerhead significance.

2014

In 2014 adidas made a big jump forward, doubling its resell presence from the year before – but still representing only 1% of the $1B+ industry.

By comparison Nike, including Jordan Brand, accounted for 96% of the secondary market. Air Jordans have dominated resell for decades. Even with adidas’ surge in 2014 it was still an afterthought, at best.

These were the top four adidas resell sneakers in 2014:

The top four resell sneakers accounted for $256K in total dollars on eBay.

Is that a lot?

Well, here’s a comparison to the top-selling Jordan:

The top selling Jordan was the Gamma Blue 11 which sold over 13K pairs for almost $3.8M.

It’s not even close.

And at the sneaker level, it was actually worse. adidas was notorious for playing bait and switch with the resell community. Releasing a hyped shoe in limited quantities, letting the resell market take hold, prices soaring . . . and then restock. Death to resell.

The ZX Flux Multi, despite being the top reselling adidas of 2014, was the poster child for this; for adidas’ failed attempt to create real, genuine, sneakerhead significance.

It was a brand new model – one of the first really interesting new models from adidas in a long while. The unique material on the upper allowed for the creation of an extraordinary colorway. The kaleidoscope effect was unlike anything previously seen.

It was such a great shoe that I took this picture of it – which I finally have an excuse to use:

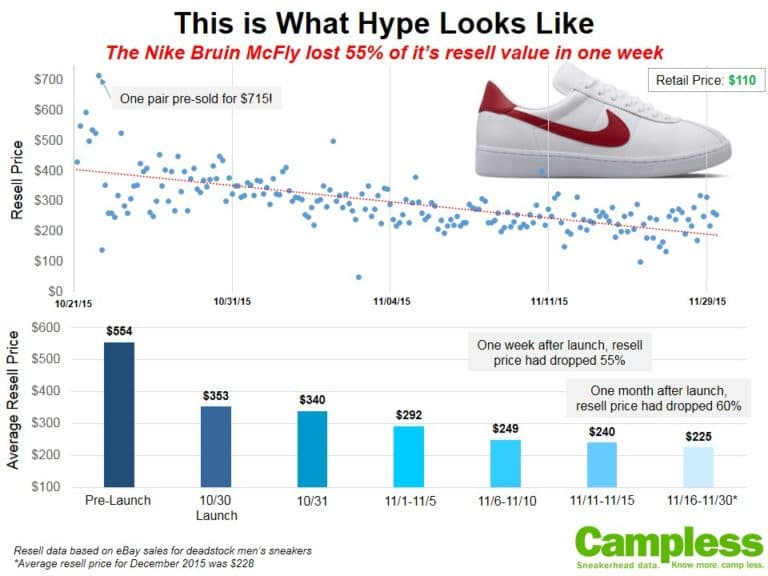

The ZX Flux Multi initially released in such limited quantities sneakerheads and resellers alike went nuts. Some pairs sold for as much as $270. It was a $90 retail sneaker which was reselling for an average of $215.

$215 resell on a $90 retail is a resell profit margin of 139%.

How rare is that?

Of the 473 sneakers that Campless tracked in 2014, only 22 pairs had a resell profit margin greater than 139% – and those were legendary quickstrikes like the Yeezy 2 Red October, Kobe 9 HTM, Jordan 1 Fragment, Lebron 11 NBA2k14, Jordan 8 Doernbecher, Air Max Lunar 90 Moon Landing, Jordan 1 Jeter, Asics GL3 Solefly, Air Force 1 Lunar Patriots, Nike SB Dunk Tiffany High, the two Supreme Foamposites, the first two Jordan Futures, and two Kobe Preludes.

The ZX Flux was in elite company.

The ZX Flux Multi was going to be an iconic shoe that sat on sneakerhead mantles for years.

The ZX Flux Multi was adidas’ first legit move upward:

But then adidas restocked it. And restocked it. And restocked it.

And the resell price did this:

Usually when we do a chart like this we put vertical lines to show when the restocks happened . . . but there were so many ZX Flux Multi restocks we genuinely couldn’t track them all. Now you can probably find a pair for less than retail.

And so just as quickly, the ZX Flux Multi restock was adidas’ first big negative move:

Who’s to say what would have happened if adidas had left well enough alone, if adidas had never produced another ZX Flux Multi after the initial launch?

Would we revere the Multi like we do the Fragment 1?

Would the ZX Flux model be as important to adidas’ identity as the Ultra Boost and NMD?

Does it even matter now?

You can’t take back restocks. All you can do is move on. And adidas did – in the grandest fashion possible.

2015

Thirty years of watching Nike has gotta rub off at some point, right? Maybe it was a conscious decision. Maybe it was an accident. Maybe it was Kanye himself who orchestrated it. We don’t know. But we know that it started with the Yeezy.

It started with the Yeezy 750 Light Brown on February 14th, 2015.

Merry frickin’ Valentines, resellers!

And it continued through the rest of 2015.

Within a month the 750 Brown was reselling at a margin of over 400%. The Turtledove, over 300%. Every 350 and 750 were worth a grand plus. By the end of 2015, adidas had increased their share of the resell market by 20 times – from 1% to 20%.

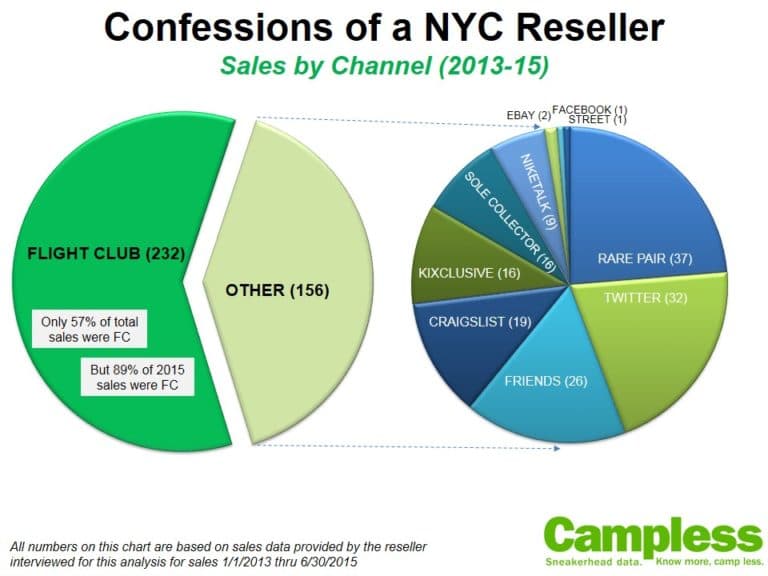

The relative share of the resell market now looked like this, with all of adidas’ gains coming directly from Nike.

And when we compare the top reselling adidas from 2014 to 2015, it’s comical:

Key Insights:

- The top four Yeezys in 2015 accounted for more than 50 times as many resell dollars as the top four adidas in 2014.

- The top reselling adidas on eBay was the adidas Yeezy 350 Turtledove which sold over 7,100 pairs for a total of $4.9M.

- By comparison, the top selling Jordan was the Legend Blue 11, which sold over 12K pairs for only $3.1M.

So that’s it, right? The Yeezy fixed everything.

Well….

Don’t let him read this, but even Kanye can’t offset bad restock policy.

Even when he wears the shoe himself:

The Ultra Boost has been a monster shoe for adidas at both retail and resell. But we forget that it almost went the way of the ZX Flux. The first truly hyped, resellable Ultra Boost was the White/White with the black bottom sole. It launched in May of 2015, three months after the Yeezy, and once Kanye wore it, resale skyrocketed. One eBay listing famously asked for $25,000.

The $180 retail shoe came out of the gate at $280, reselling ahead of its July 1 release, and by September was selling for an average of $364 – just over 100% margin – and on icon status track.

By now the Turtle Dove and Pirate Black had both launched to astronomical resell fanfare, so you’d think the plan was on lock.

But no.

Even in the middle of this historical rise from resell afterthought to secondary market powerhouse, adidas couldn’t resist. The lure of quick retail dollars was too much. Restock. Restock. And here’s what it was in February of 2016:

It’s restocked quite a few more times since then. It might be restocking right now, while you’re reading this. Seriously. Today you can find the Ultra Boost White/White for significantly less than what it could have been due to the restocks that happened, and fear of more.

Interestingly, once adidas made the White/White a general release, always-available model, it fully embraced that choice. It leveraged other, limited Ultra Boosts to maximize retail sales of the White/White and, conversely, leveraged ubiquitous availability of the White/White to drive more cache around those limited colorways. adidas also found more than a dozen ways to release an all white shoe. This was a smart, well-executed move and one that we will elaborate more on it later.

But at the time, and in the immediate aftermath of the two restocks, it had a decidedly negative impact on adidas’ sneakerhead significance.

If you’ve been keeping score on our “up & down” template, it now looks like this:

Time for a positive.

Enter the adidas NMD, a.k.a., Nomad.

2016

In December of 2015 adidas released a new model – the adidas NMD – in the super-limited “Key City” and now-classic Core Black-Lush Red colorways.

Immediately it was a hit. No one could figure out what the Lego-like blocks on the sole were, but people liked it.

The initial wave of colorways was a great mix of collab (Nice Kicks), outstanding new patterns (Glitch, Yellow Camo), and classic (Key City, Core Black). They were all very limited, and we know what happens then→ demand is high and resell prices soar.

But then adidas did something they’ve never done before. They did something that NO sneaker company has ever done before.

They kept going limited.

They went ALL limited.*

*[Not to be confused with Garnett and Marbury’s “All Nude“.]

Ordinarily, brands use limited releases to drive overarching brand awareness, hype and prestige. It only takes a few to create buzz – buzz that brands use to drive retail sales. But limited releases are just that – limited – so if the goal is to drive retail sales then, logically, brands should very quickly move on to general release, high production pairs.

We see this all the time. adidas released the SL Loop with just one limited collab (the Wish ‘Independent Currency’) before going GR on every subsequent pair. The first LeBron X release, the limited Crown Jewel, is still one of the most expensive in a series that includes over thirty-five GR pairs.

But adidas didn’t do that.

As of September 30, 2016, adidas had released over eighty different NMDs and not a single one was a true general release. This number is so overwhelming that, for perhaps the first time ever, sneakerheads have run out of nicknames. They’ve resorted to listing NMDs by model number. What’s most impressive though is the fact that they are ALL reselling.

100% of the NMDs we track (80 out of 80) were* reselling for more than the retail price. That is unheard of.

*(Data was as of Sept 30, 2016. Since then we’ve seen some GR NMDs restock and therefore resell price has come down).

It’s not just that NMDs are reselling, but they’re reselling at nice premiums. Your average sneakerhead can make a decent return on NMDs, which is more than you can say about many sneakers that kids had traditionally used to build their collections.

Key Insights:

- Through September of 2016, 55% of NMDs have a resell profit of $75 or more – compared to only 28% of Retro Jordans!

- There have been more NMDs released (80) than Retro Jordans (58), although there were many more pairs of each Jordan released than each NMD – which is part of the reason that resell premiums are higher on NMDs.

- Not used in our data-set but worth mentioning are the two Friends and Family NMDs; the Burgundy HU and Pitch Black. Without a public release and retail price it didn’t make sense to include, but worth noting that each sell for a couple stacks.

Bottom line is that, on a per-shoe basis, kids can make more money flipping NMDs than Jordans.

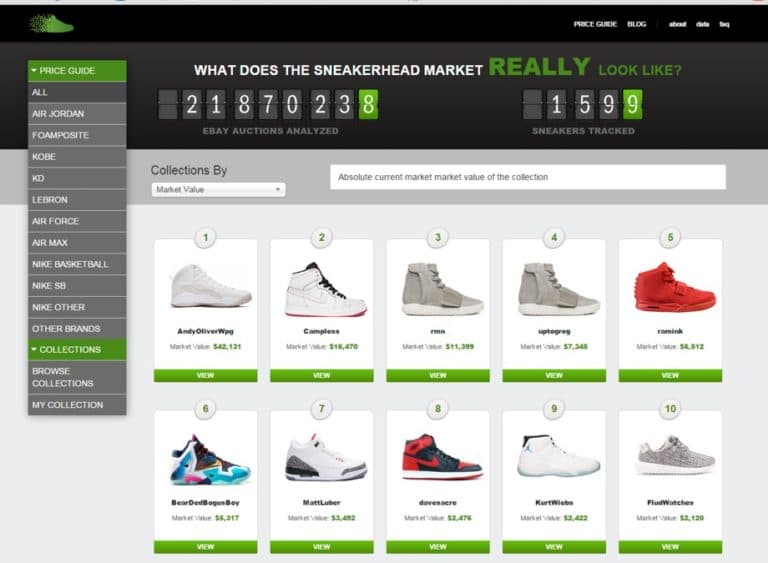

As we discussed in detail in The State of Jordan Resell (Spring 2016), Nike and Jordan Brand have continued to increase retail price and supply and, in the process, squeeze profits out of the resell game. Maybe this is OK for Jordan Brand – Retro Jordans still sell through and resell – but our hypothesis has always been that resell premium is an indicator of overall brand prestige.

Perhaps more importantly is the concept of the “mini-reseller” – the 15 year old kid who can’t afford to buy $200 sneakers every weekend, but is able to build his collection by getting three pairs of Jordans and selling two to pay for the third. For the longest time, that mini-reseller was able to build his collection on the back of Nike and Jordans. But with resell profits on Retros shrinking, that’s no longer effective against what else is selling in the market.

The NMD may have replaced Jordans as the ideal shoe to flip to build a collection.

When you consider the quick resell growth of the NMD, with continued Yeezys released in 2016 (7 pairs so far), and Ultra Boosts continuing to sell in many different colorways, it’s no surprise that adidas’ share of resell market has jumped even higher.

Through September of 2016, adidas represents 30% of the resell market, in dollars. The majority of those dollars are still Yeezy (75%), but NMDs represent 14% and Ultra Boost 7%.

adidas’ extra 10% share has come directly from Nike. Don’t confuse this with Nike losing its dominance on the resell market, but adidas’ growth is definitely a big deal.

The overall landscape now looks like this:

But I am POSITIVE that if adidas hadn’t made another huge mistake along the way that they’d have a much larger share of the resell market – maybe as much as 50%. Because as much of a resell cash cow as the Yeezy is today, it’s actually a tempered version of what it could be.

That’s right. Tempered.

Yeezys almost exploded – for real – but the Pirate Black restock changed everything:

Before we talk about what happened, before we talk about what could have been, let’s look at the crazy, unique Yeezy landscape as existed right before the Pirate Black restock.

This chart plots all of the resell sneakers tracked by Campless/StockX for the 14 months ending March 2016 by average resell price (X-axis) and total pairs sold (Y-axis) on StockX, other online markets, and consignment.

Key Insights:

- We’ve cut the chart into four quadrants based on 1,000 pairs sold (horizontal red dotted line) and $1,000 average price (vertical red dotted line).

- As expected, the overwhelming majority of sneakers clump in the lower left-hand quadrant – less than 1,000 pairs sold at less than $1,000.

- There are a dozen or two clustered in the upper left-hand quadrant – more than 1,000 pairs sold – and almost all of them are selling for $250-350. That makes sense. Lots of pairs, price is low.

- There’s also a few dozen in the lower right-hand quadrant – more than $1,000 – and almost all of them are sitting on the X-axis, meaning less than 100 pairs sold. That also makes sense. Rare sneakers, high resell.

But there are exactly six pairs in the upper right-hand quadrant – more than 1,000 pairs resold at more than $1,000.

Do you want to guess which six sneakers these are?

That’s right. The six Yeezys.

That’s nuts.

We already knew that Yeezys are outliers in terms of hype and controversy and other qualitative areas. But now we can also say that, statistically, Yeezys are outliers, as well.

For context, here’s where the top Nike / Jordans sit on the chart:

Key Insights:

- Not surprisingly, Fragments lead the way as the most expensive pair that has been resold the most. Also not surprising, a Jordan 11 (in this case Legend Blue) resold the most pairs.

- Comparatively, the Turtledove was reselling for about the same price as the Fragment (remember this data is as of March 2016), but had been resold 14 times as often. The Legend Blue 11, which had the closest volume to the Turtledove, was selling for 1/5 the price.

So what does this mean? It means that Yeezys are special.

For a little while, though, it wasn’t clear what this franchise was going to look like.

Through October of 2015 resell prices were increasing across the board on the top three pairs – 750 Brown, 350 Turtledove and 350 Pirate Black – but there was nothing extraordinary happening.

The resell community was being tentative, and with good reason.

Kanye had very publicly said that everyone was going to be able to get a Yeezy. That artificially slowed initial resell demand (and therefore resell prices) as people waited for his prophecy to come true, even without any understanding of how.

A restock perhaps? That would certainly fit with the way adidas had managed previously hyped releases (see, e.g., ZX Flux Multi and Ultra Boost White, above, among others).

When the 950s released – high retail price, no resell premium – it reinforced the value of the 350s and 750s.

Then the Moonrock launched in November. It was more widely available than the previous 350s, but still nowhere near “everyone will get a Yeezy”.

You know what?

Maybe Kanye changed his mind.

Maybe I won’t be able to cop a Yeezy at retail.

Oh crap!

I better grab a pair at resell RIGHT NOW before they get out of hand.

The 750 and Turtledove had been so limited, and there were at least a few people with the foresight to see through Kanye’s early promise, so the price premium had already been baked in.

So everyone turned to the Pirate Black.

It was a clean black shoe that anyone could wear, pretty much any time. Compared to the 750 and Turtledove, there were still enough pairs on the market. Compared to the Moonrocks it was more limited, so more desirable.

And so the run started.

This wasn’t the 1930 run on U.S. banks.

But it was – genuinely – the closest thing we’ve ever seen in the sneaker world.

Starting in November of 2015, the average resell price of the Yeezy 350 Pirate Black increased by 48% in two months!

To put into perspective how crazy this price increase price is . . . consignment shop average price had increased to over $1,700!

Then the 350 Oxford Tan dropped. Yet another limited Yeezy. Sneakerheads and Kanye fans alike, particularly those who had (seemingly) missed out on the 750 and Turtledove forever, scrambled to grab the last ‘first’ Yeezy they could.

And it wasn’t stopping.

At StockX, which was actually in a closed beta at the time (we opened to the world on February 9, 2016), there was as much Bid/Ask activity on the Pirate Blacks as there was on all other shoes combined. Some sellers had already moved Asks to as much as $2,000!

This. Was. Going. To. F@$#ing. Explode.

The Pirate Black was going to be a $3,000 shoe in less than 3 months.

The 750 Brown and 350 Turtledove would have been proportionately more.

But all of that came to a crashing halt on February 4, 2016.

After a few unconfirmed rumors about a potential Yeezy drop, Sneaker News reported that the Yeezy 350 Pirate Black would be restocking on February 19. According to the post, adidas confirmed that there would be “double the amount of pairs compared to the first Pirate Black release”.

Five days later, on February 9, 2016, adidas confirmed the restock with this tweet.

Every sneakerhead’s fears came crashing into reality.

adidas is restocking. Again.

UGH.

For a moment, for a brief, shining moment, we thought this was different. We thought Yeezys were special. We thought adidas wouldn’t restock them.

Just as soon as we had collectively erased Kanye’s ‘everyone will get a pair’ promise from our consciousness, just then, adidas pulled the ultimate screw you and restocked them.

ZX Flux Multi. Ultra Boost White. Pirate Black 350.

Resell prices started crashing IMMEDIATELY. On the announcement. Didn’t even need to wait for the actual restock.

And they all started crashing; not just the Pirate Black. The mystique had been destroyed. Now we all knew that adidas could restock any Yeezy at any time. Not even Doc Brown with a Delorian could undo this mess.

In less than two months the Pirate Black resell price dropped by 29%.

Today, on StockX, you can buy a 2015 Pirate Black for around $1,000. As recently as September of 2016 there were pairs at consignment (Stadium Goods) for $1095.

That’s almost exactly what it was selling for one year ago. That’s unheard of for pretty much any hyped resell shoe – they all go up in value over time as deadstock pairs exit the market – but even moreso for a Yeezy.

In short, Yeezy life as we know it would not be the same today if not for the Pirate Black restock. We might be living in some alternate universe where every 350 goes for $7,000 and there are two Jet Li’s trying to kill each other.

Instead, it’s just a $1,000 shoe.

The power of the Yeezy – the influence of Kanye (as I’ve written about before) – is so great that, even despite the alternate universe killing restock, it still stands as the defining secondary market shoe of this era, and is still continuing to propel adidas into sneakerhead significance.

We’ve denoted the final “up” move here as a single move, but the reality is that since the Pirate Black restock, adidas has had a near flawless run of Yeezy, NMD and Ultra Boost releases which have really helped maintain its relevance throughout 2016.

Today the original Core Black NMD sells for over $1,000.

Here are the most expensive NMDs on the market:

And here are the most expensive Ultra Boosts

Key Insights:

- Collabs make up the majority of the top 10 for both models.

- In general, the top NMDs sell for more than the top Ultra Boosts.

- NMDs have a lower retail price than Ultraboosts so the profit margins are even greater. NMD is a prime commodity for the “mini-reseller”

FINAL THOUGHTS, FOR NOW AND THE FUTURE:

What is adidas doing now? What does the future look like?

Restocks Becoming Less Harmful

If you take away one thing from this article it’s that’s no sneaker is safe from a restock, not even a Yeezy. Yet it certainly appears that adidas is getting better at how to manage restocks.

NMDs have had both a sporadic and prolific rollout and, as a result, restocks have had a less significant impact on any one colorway. For example, the White Monochrome NMD first appeared at random local sneaker retailers. The social and blog chatter, as it always does, got busy dissecting location and inventory counts. Then it got an official release date from adidas. And finally, it was hit with a restock. Whether intentional or not, what happened here was smart – adidas played the same game it has always done with restocks, but did so on a much smaller scale and with less fanfare, somewhat hidden among so many other NMD releases. As a result, the market wasn’t flooded to the extent of the ZX Flux Multi, and our resell data backs that up.

This isn’t to say we think adidas should do more restocks, though – far from it. And just so there is absolutely no confusion, I’d like every adidas exec to take this oath with me: “We will never restock Yeezys. We will never restock Yeezys. We will never restock Yeezys.” Say that three times before you go to bed every night, and anytime you need to step out of a meeting to clear your head. And if you need to add a Serenity Now! to the end, go for it.

Revitalization of Consortium

adidas Consortium was last mentioned in this post pre-2014 and for good reason – the collaboration initiative group has been pretty dormant since then. But in 2016 it came back in full force with the Consortium tour, giving creative power back to worldwide boutiques and designers in hopes of creating sneakerhead significant shoes. Solebox and Nice Kicks used the power of their selected models (Ultra Boost Uncaged and NMD, respectively) to take their pairs to the top of the resell charts. Ronnie Fieg took a more obscure model, the Tubular Doom, and was still able to create buzz. Perhaps more importantly, adidas has let certain collaborators create their own model variant – Pharrell’s Human Race NMD and Ronnie’s Ultra Boost Mid are shining examples of adidas’ trust in true creators.

Signature Basketball

Over the past four years, Nike has really moved away from leveraging the resell market for their signature basketball lines. Back in 2012 the LeBron 9, Kobe 6 and KD4 had a plethora of limited and exclusive drops that held real value on the secondary market. But fast forward to the latest models – Lebron 13, Kobe 11 and KD 9 – and they are almost all GRs with hardly any resell potential. This is either a warning for adidas – to keep the new Harden and growing Lillard lines away from the resell game – or a huge opening for adidas to capitalize on the lack of exclusive basketball kicks on the market. The decline of basketball at retail in the past two years is often associated with changing trends, increased prices and poor product, but you can’t overlook the fact that these shoes just aren’t ‘sneakerhead significant’ anymore. We’ll be watching adidas closely here.

Yeezy v2

So far, it looks like the mantra has been working:

There hasn’t been another restock since the Pirate Black, nor have there even been rumors of one. The first v2 was a hit and it sounds like more are coming. It feels like quantities have been increasing (the v2 Beluga is selling for around $650, as opposed to the other 350s which are all over $1000), but not too quickly (the v2 Beluga is still selling for 3x retail). This is exactly how we would grow the Yeezy brand if it was up to us. With every release, produce just a few more. Don’t get greedy. Don’t overproduce. Don’t restock.

Yes, it will take absolutely forever to sell as many Yeezys as Jordans. There are rumored to be over 1 million Space Jam 11s coming out in December. But Jordans have been around for 31 years, and Yeezy two. Nike and Jordan still dominate this space and they will continue to. No matter how much success adidas is having right now, the last thing anyone should do is count out Mike.

But that shouldn’t be the goal – or, at least not the short term goal.

For now, Yeezy has helped make adidas relevant in the resell market, which is a product of (not the reason for) sneakerhead significance. NMDs have helped mini-resellers fund their collections, and Ultra Boosts have allowed everyone to tap into the carryover cool.

And that’s the history of adidas resell, which makes the future a fun time to be a sneakerhead.

Because as we all know, the future hasn’t been written yet. It’s whatever you make of it. So make it a good one.